Rising Demand for Automation

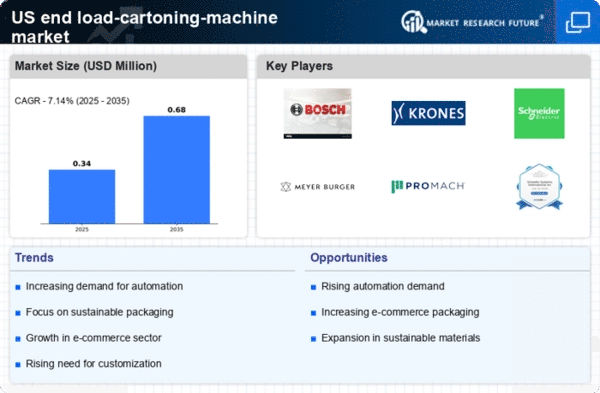

The end load-cartoning-machine market experiences a notable surge in demand for automation across various sectors, particularly in food and beverage, pharmaceuticals, and consumer goods. As companies strive to enhance operational efficiency, the integration of automated cartoning solutions becomes increasingly appealing. In 2025, the market is projected to grow at a CAGR of approximately 6.5%, driven by the need for faster production rates and reduced labor costs. Automation not only streamlines packaging processes but also minimizes human error, thereby improving product quality. This trend indicates a shift towards more sophisticated machinery that can adapt to varying production volumes, ultimately benefiting the end load-cartoning-machine market. Furthermore, the push for automation aligns with broader industry goals of increasing productivity and maintaining competitiveness in a rapidly evolving marketplace.

Growth in E-commerce and Retail

The end load-cartoning-machine market is significantly influenced by the expansion of e-commerce and retail sectors in the United States. As online shopping continues to gain traction, the demand for efficient packaging solutions rises correspondingly. In 2025, e-commerce sales are expected to account for over 20% of total retail sales, necessitating advanced cartoning machinery that can handle diverse product sizes and packaging requirements. This growth compels manufacturers to invest in end load-cartoning machines that offer flexibility and speed, ensuring timely delivery and customer satisfaction. The ability to quickly adapt to changing consumer preferences and packaging standards is crucial for businesses aiming to thrive in this competitive landscape. Consequently, the end load-cartoning-machine market is poised for substantial growth as it caters to the evolving needs of the retail and e-commerce industries.

Increased Focus on Sustainability

The end load-cartoning-machine market is increasingly influenced by sustainability initiatives as companies strive to reduce their environmental footprint. There is a growing demand for eco-friendly packaging solutions that utilize recyclable materials and minimize waste. In 2025, it is expected that sustainable packaging will represent a significant portion of the overall packaging market, prompting manufacturers to develop end load-cartoning machines that support these initiatives. This shift not only aligns with consumer preferences for environmentally responsible products but also helps companies comply with stringent regulations regarding packaging waste. As sustainability becomes a core business strategy, the end load-cartoning-machine market is likely to benefit from innovations that enhance the recyclability and efficiency of packaging processes, ultimately contributing to a more sustainable future.

Focus on Product Safety and Compliance

In the end load-cartoning-machine market, there is an increasing emphasis on product safety and regulatory compliance. Industries such as pharmaceuticals and food processing are particularly stringent regarding packaging standards, necessitating machinery that meets specific safety criteria. As regulations evolve, manufacturers are compelled to adopt advanced cartoning solutions that ensure product integrity and traceability. The market is likely to see a rise in demand for machines equipped with features such as tamper-evident seals and serialization capabilities. This focus on compliance not only protects consumers but also enhances brand reputation, thereby driving growth in the end load-cartoning-machine market. In 2025, it is anticipated that compliance-related investments will constitute a significant portion of overall packaging expenditures, further underscoring the importance of safety in packaging operations.

Technological Integration and Smart Features

The end load-cartoning-machine market is witnessing a trend towards the integration of smart technologies and IoT capabilities. As manufacturers seek to optimize their operations, the incorporation of data analytics and machine learning into cartoning processes becomes increasingly relevant. These technologies enable real-time monitoring and predictive maintenance, which can significantly reduce downtime and enhance productivity. In 2025, it is projected that smart features will account for a substantial share of new machine sales, as companies prioritize investments that offer long-term operational benefits. This technological evolution not only improves efficiency but also allows for better resource management, aligning with the broader industry trend of digital transformation. Consequently, the end load-cartoning-machine market is likely to expand as businesses adopt these innovative solutions to stay competitive.