Increasing Regulatory Scrutiny

The emission monitoring-system market is experiencing heightened regulatory scrutiny as federal and state agencies enforce stricter environmental regulations. The U.S. Environmental Protection Agency (EPA) has implemented more rigorous standards for emissions reporting, compelling industries to adopt advanced monitoring systems. This regulatory environment is expected to drive market growth, as companies seek to comply with legal requirements and avoid substantial fines. In 2024, the EPA reported that non-compliance could result in penalties exceeding $1 million for major corporations. Consequently, the demand for reliable emission monitoring systems is likely to surge, as businesses prioritize compliance to mitigate financial risks and enhance their reputations in an increasingly eco-conscious market.

Investment in Clean Technologies

The emission monitoring-system market is benefiting from increased investment in clean technologies, driven by both public and private sectors. The U.S. government has allocated substantial funding for clean energy initiatives, which often include the implementation of advanced emission monitoring systems. In 2025, federal investments in clean technology are projected to exceed $10 billion, creating opportunities for companies specializing in emission monitoring solutions. This influx of capital is likely to stimulate innovation and development within the market, as businesses seek to leverage new technologies to improve emissions tracking. As the focus on clean technologies intensifies, the emission monitoring-system market is expected to expand, reflecting the growing commitment to environmental stewardship.

Corporate Sustainability Initiatives

The emission monitoring-system market is increasingly influenced by corporate sustainability initiatives, as businesses recognize the importance of reducing their carbon footprints. Many U.S. companies are setting ambitious sustainability goals, aiming for net-zero emissions by 2030 or 2040. This shift is driving the adoption of emission monitoring systems, which provide the necessary data to track progress toward these goals. According to a recent survey, 70% of U.S. corporations have integrated sustainability into their core strategies, highlighting the growing importance of emissions management. As organizations strive to enhance their environmental performance, the demand for sophisticated monitoring solutions is expected to rise, further propelling market growth.

Public Awareness and Consumer Demand

The emission monitoring-system market is being shaped by increasing public awareness and consumer demand for environmentally responsible practices. As consumers become more informed about climate change and its impacts, they are more likely to support companies that demonstrate a commitment to reducing emissions. This shift in consumer behavior is prompting businesses to invest in emission monitoring systems to showcase their environmental efforts. A recent study indicated that 65% of U.S. consumers prefer brands that prioritize sustainability, suggesting that companies may enhance their market position by adopting transparent emissions tracking. This trend indicates a potential growth trajectory for the emission monitoring-system market as businesses respond to consumer expectations.

Technological Integration and Innovation

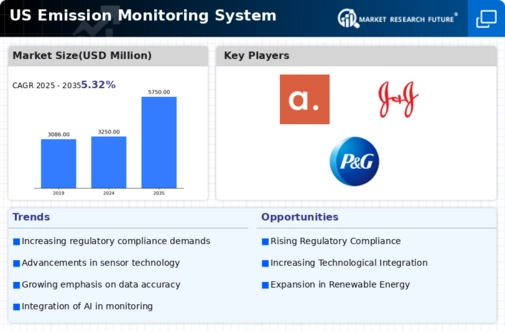

The emission monitoring-system market is witnessing a wave of technological integration and innovation, which is reshaping how emissions are tracked and reported. Advanced technologies such as artificial intelligence (AI) and the Internet of Things (IoT) are being incorporated into monitoring systems, enhancing their accuracy and efficiency. For instance, AI algorithms can analyze vast amounts of data in real-time, providing actionable insights for emissions reduction. The market for these innovative solutions is projected to grow at a CAGR of 10% from 2025 to 2030, indicating a robust demand for cutting-edge emission monitoring technologies. This trend suggests that companies investing in advanced systems may gain a competitive edge in the evolving regulatory landscape.