Technological Innovations

Technological advancements are significantly influencing the emergency lighting market. Innovations such as LED technology, smart lighting systems, and integrated emergency solutions are enhancing the efficiency and effectiveness of emergency lighting. LED lights, for instance, consume less energy and have a longer lifespan compared to traditional lighting, making them a preferred choice for many organizations. The integration of smart technology allows for real-time monitoring and automated testing of emergency lighting systems, ensuring they function optimally when needed. As organizations increasingly adopt these technologies, the emergency lighting market is expected to grow, with estimates suggesting a market value of around $1.5 billion by 2025. This trend underscores the importance of innovation in meeting safety standards.

Increased Safety Regulations

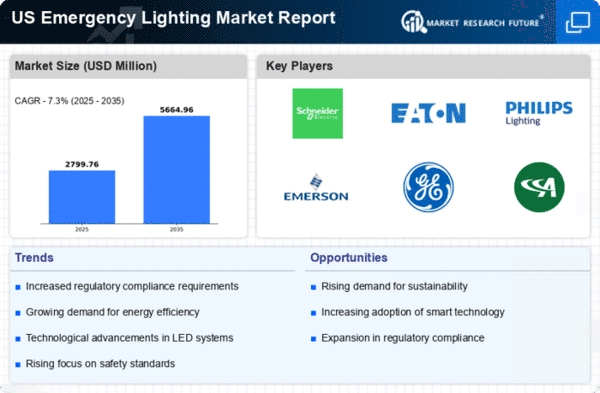

The emergency lighting market is experiencing growth due to heightened safety regulations across various sectors. Regulatory bodies in the US have mandated that commercial buildings, educational institutions, and healthcare facilities implement effective emergency lighting systems. This is particularly evident in the National Fire Protection Association (NFPA) codes, which require adequate illumination during emergencies. As a result, businesses are investing in advanced emergency lighting solutions to comply with these regulations, thereby driving market expansion. The market is projected to reach approximately $2 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 5%. This trend indicates a strong commitment to safety and compliance, which is likely to bolster the emergency lighting market further.

Increased Investment in Smart Buildings

The trend towards smart buildings is significantly influencing the emergency lighting market. As more organizations invest in smart technologies, the integration of emergency lighting systems with building management systems is becoming increasingly common. This integration allows for enhanced control and monitoring of emergency lighting, ensuring that systems are always operational and compliant with safety standards. The market for smart buildings is projected to grow at a CAGR of 10% over the next five years, which will likely drive demand for advanced emergency lighting solutions. This shift towards smart infrastructure not only improves safety but also enhances energy efficiency, making it a key driver for the emergency lighting market.

Growing Awareness of Emergency Preparedness

There is a rising awareness regarding emergency preparedness among businesses and institutions, which is positively impacting the emergency lighting market. Organizations are recognizing the critical role that effective emergency lighting plays in ensuring the safety of occupants during unforeseen events. This awareness is leading to increased investments in emergency lighting systems, particularly in high-risk environments such as hospitals, schools, and public venues. According to recent surveys, approximately 70% of businesses report having upgraded their emergency lighting systems in the past two years. This trend indicates a proactive approach to safety, which is likely to sustain the growth of the emergency lighting market in the coming years.

Urbanization and Infrastructure Development

The ongoing urbanization and infrastructure development in the US are contributing to the expansion of the emergency lighting market. As cities grow and new buildings are constructed, the demand for reliable emergency lighting systems increases. Urban areas, with their dense populations and high-rise buildings, require effective emergency lighting solutions to ensure safety during emergencies. The construction of new commercial and residential properties is expected to drive the market, with estimates indicating a potential Market Valuation of $1.8 billion by 2026. This growth is further supported by government initiatives aimed at enhancing public safety in urban environments, thereby reinforcing the importance of emergency lighting systems.