Regulatory Support and Incentives

Government regulations and incentives aimed at promoting electric vehicle adoption are significantly influencing the electric vehicle-capacitors market. In 2025, various federal and state initiatives are in place to encourage the transition to EVs, including tax credits and rebates for consumers. These policies not only stimulate EV sales but also create a favorable environment for capacitor manufacturers. The electric vehicle-capacitors market is likely to see increased investment as companies align their products with regulatory requirements. Furthermore, the push for stricter emissions standards is compelling automakers to adopt more efficient technologies, including advanced capacitors, to enhance vehicle performance and reduce environmental impact. This regulatory landscape is expected to drive innovation and growth within the electric vehicle-capacitors market.

Growing Demand for Electric Vehicles

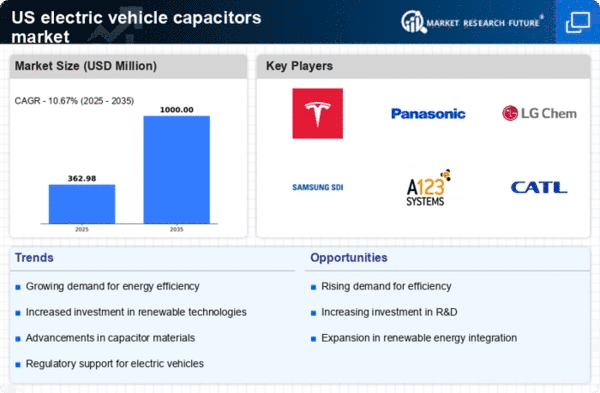

The increasing consumer preference for electric vehicles (EVs) is a primary driver for the electric vehicle-capacitors market. As more individuals opt for EVs, the need for efficient energy storage solutions becomes paramount. In 2025, the EV market in the US is projected to grow by approximately 30%, leading to a corresponding rise in demand for capacitors that enhance vehicle performance. These capacitors play a crucial role in managing energy flow, improving efficiency, and extending battery life. Consequently, manufacturers are focusing on developing advanced capacitor technologies to meet this burgeoning demand. The electric vehicle-capacitors market is thus positioned to benefit significantly from this trend, as automakers seek to integrate high-performance capacitors into their designs to meet consumer expectations and regulatory standards.

Investment in Charging Infrastructure

The expansion of charging infrastructure across the US is a critical driver for the electric vehicle-capacitors market. As more charging stations are established, the convenience of owning an electric vehicle increases, thereby boosting consumer adoption. In 2025, the US is expected to see a substantial increase in the number of public and private charging stations, which will necessitate the integration of advanced capacitors in charging systems. These capacitors are vital for managing power delivery and ensuring efficient charging processes. The electric vehicle-capacitors market is likely to experience growth as infrastructure investments create new opportunities for capacitor manufacturers. This trend indicates a synergistic relationship between charging infrastructure development and the demand for high-performance capacitors in the electric vehicle sector.

Technological Innovations in Capacitor Design

Innovations in capacitor technology are reshaping the electric vehicle-capacitors market. Recent advancements in materials science and engineering have led to the development of capacitors with higher energy densities and improved thermal stability. These innovations are crucial for enhancing the performance of electric vehicles, particularly in terms of acceleration and energy efficiency. In 2025, the market is witnessing a shift towards supercapacitors and hybrid capacitors, which offer rapid charging capabilities and longer lifespans. As automakers increasingly incorporate these advanced components into their vehicles, the electric vehicle-capacitors market is expected to expand. The ongoing research and development efforts in capacitor technology suggest a promising future, with potential applications extending beyond traditional EVs to include energy storage systems and renewable energy integration.

Rising Consumer Awareness of Environmental Impact

Consumer awareness regarding the environmental impact of transportation is driving the electric vehicle-capacitors market. As individuals become more conscious of their carbon footprints, the demand for electric vehicles is surging. This shift in consumer behavior is prompting manufacturers to prioritize sustainable practices in their production processes. The electric vehicle-capacitors market is likely to benefit from this trend, as capacitors are essential for optimizing energy use in EVs. In 2025, it is anticipated that a significant % of consumers will consider environmental factors when purchasing vehicles, further propelling the demand for electric vehicles and, consequently, capacitors. This growing emphasis on sustainability is encouraging innovation in capacitor design, leading to more efficient and eco-friendly products.