Increased Regulatory Standards

The electric insulator market is influenced by the implementation of stricter regulatory standards aimed at improving safety and reliability in electrical systems. In the US, regulatory bodies are continuously updating guidelines to ensure that insulators meet higher performance criteria. For instance, the National Electrical Safety Code (NESC) has introduced new requirements that impact the design and manufacturing processes of insulators. As a result, manufacturers are compelled to invest in research and development to comply with these regulations, which may lead to enhanced product offerings. This trend not only drives innovation within the electric insulator market but also ensures that products are safer and more efficient, ultimately benefiting end-users.

Rising Demand for Renewable Energy

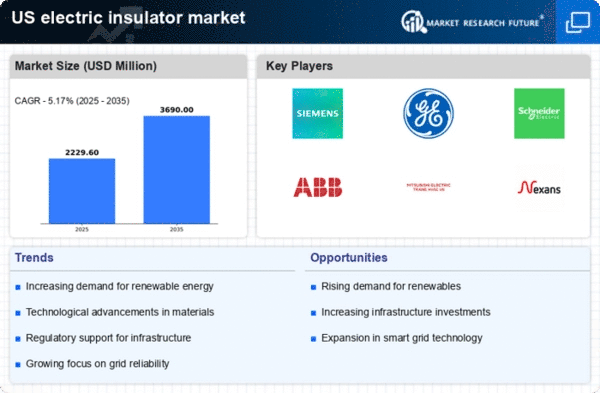

The electric insulator market is experiencing a notable surge in demand due to the increasing focus on renewable energy sources in the US. As the country transitions towards wind, solar, and hydroelectric power, the need for reliable and efficient insulators becomes paramount. In 2025, investments in renewable energy infrastructure are projected to exceed $100 billion, driving the demand for high-performance insulators that can withstand varying environmental conditions. This shift not only enhances energy efficiency but also necessitates the development of advanced materials and technologies in the electric insulator market. Consequently, manufacturers are likely to innovate and adapt their product lines to meet the specific requirements of renewable energy applications, thereby expanding their market presence.

Expansion of Smart Grid Technologies

The electric insulator market is poised for growth as smart grid technologies gain traction across the US. The integration of advanced communication and monitoring systems into the electrical grid enhances efficiency and reliability, necessitating the use of high-quality insulators. By 2025, the smart grid market is expected to reach $60 billion, with a significant portion allocated to upgrading existing infrastructure. This modernization requires insulators that can support increased data transmission and withstand higher voltage levels. As utilities invest in smart grid solutions, the demand for innovative insulator designs that can accommodate these advancements is likely to rise, positioning the electric insulator market for substantial growth.

Technological Innovations in Material Science

The electric insulator market is benefiting from advancements in material science, which are leading to the development of superior insulating materials. Innovations such as polymer composites and advanced ceramics are enhancing the performance characteristics of insulators, making them more durable and efficient. In 2025, the market for advanced insulating materials is expected to grow by approximately 15%, driven by the need for insulators that can withstand extreme weather conditions and high voltage applications. These technological advancements not only improve the reliability of electrical systems but also reduce maintenance costs, making them attractive to utility companies. As a result, the electric insulator market is likely to see increased adoption of these innovative materials.

Growing Urbanization and Infrastructure Development

The electric insulator market is significantly impacted by the ongoing urbanization and infrastructure development in the US. As cities expand and populations increase, the demand for reliable electrical infrastructure rises correspondingly. In 2025, urban areas are projected to account for over 80% of the US population, necessitating substantial investments in electrical systems. This growth drives the need for durable and efficient insulators that can support the increasing load and complexity of urban electrical networks. Consequently, manufacturers in the electric insulator market are likely to focus on developing products that cater to the unique challenges posed by urban environments, thereby enhancing their market competitiveness.