Rising Demand for Renewable Energy

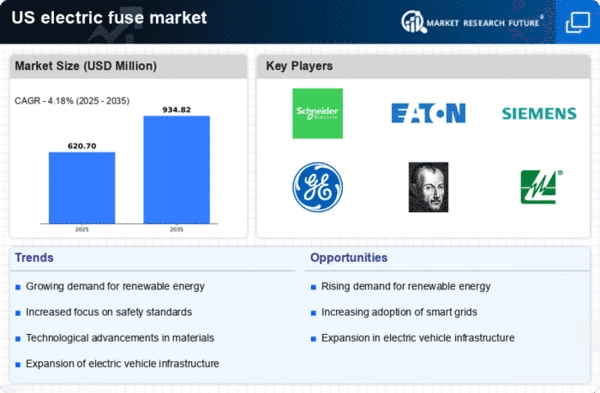

The electric fuse market is experiencing a notable surge in demand due to the increasing adoption of renewable energy sources such as solar and wind power. As more residential and commercial properties integrate solar panels and wind turbines, the need for reliable electrical protection becomes paramount. Electric fuses play a critical role in safeguarding these systems from overloads and short circuits. According to recent data, the renewable energy sector in the US is projected to grow at a CAGR of approximately 10% over the next five years, which is likely to drive the electric fuse market significantly. This trend indicates a shift towards sustainable energy solutions, necessitating advanced fuse technologies to ensure safety and efficiency in electrical systems.

Technological Innovations in Fuse Design

The electric fuse market is witnessing a wave of technological innovations that enhance the performance and reliability of fuses. Manufacturers are increasingly investing in research and development to create advanced fuse designs that offer improved response times and higher current ratings. These innovations are crucial for meeting the demands of modern electrical systems, which require greater efficiency and safety. The electric fuse market is likely to benefit from the introduction of smart fuses that can monitor electrical loads and provide real-time data to users. This trend not only enhances safety but also contributes to energy efficiency, aligning with the broader goals of sustainability in the electrical sector.

Expansion of Electric Vehicle Infrastructure

The electric fuse market is poised for growth as the infrastructure for electric vehicles (EVs) expands across the US. With the increasing number of EVs on the road, there is a corresponding need for robust charging stations equipped with appropriate electrical protection devices. Electric fuses are essential components in these charging systems, ensuring safe operation and preventing electrical failures. The US government has committed to investing over $7 billion in EV charging infrastructure, which is expected to create substantial opportunities for the electric fuse market. This investment not only supports the transition to cleaner transportation but also highlights the critical role of electric fuses in maintaining the integrity of EV charging systems.

Increased Focus on Electrical Safety Standards

The electric fuse market is influenced by the heightened emphasis on electrical safety standards in the US. Regulatory bodies are continuously updating safety codes and standards to mitigate risks associated with electrical systems. This trend compels manufacturers to innovate and produce fuses that comply with the latest safety regulations. The electric fuse market is likely to see a rise in demand for fuses that meet these stringent standards, as consumers and businesses prioritize safety in their electrical installations. Furthermore, the National Fire Protection Association (NFPA) has reported that electrical failures are a leading cause of residential fires, underscoring the importance of reliable fuses in preventing such incidents.

Growth in Construction and Infrastructure Projects

The electric fuse market is benefiting from the ongoing growth in construction and infrastructure projects across the US. As urbanization continues to rise, there is an increasing demand for residential, commercial, and industrial buildings, all of which require reliable electrical systems. Electric fuses are integral to these systems, providing essential protection against electrical faults. Recent statistics indicate that the construction industry in the US is expected to reach a value of $1.8 trillion by 2026, which could significantly bolster the electric fuse market. This growth is likely to drive innovation in fuse technology, as manufacturers seek to meet the evolving needs of modern electrical installations.