Rising Environmental Concerns

Environmental concerns are increasingly influencing consumer preferences and corporate strategies, thereby impacting the electric drone market. As awareness of climate change and pollution grows, there is a shift towards sustainable practices. Electric drones, which produce lower emissions compared to traditional fuel-powered aircraft, are becoming a preferred choice for businesses aiming to reduce their carbon footprint. The electric drone market is likely to see heightened demand as companies adopt greener technologies to align with consumer values. This trend is further supported by government initiatives promoting clean energy solutions, which could enhance the market's growth trajectory in the coming years.

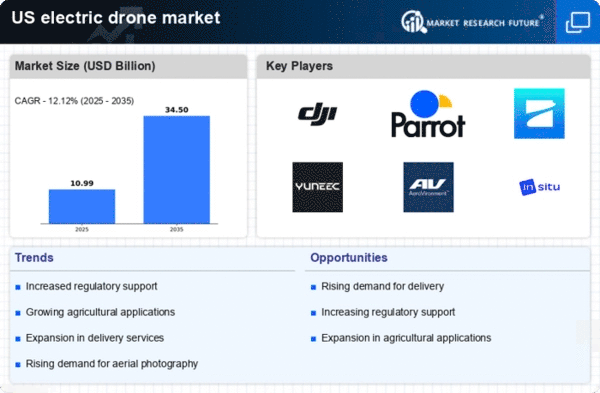

Expansion of Drone Applications

The expansion of applications for electric drones is a significant driver of growth in the electric drone market. Industries such as agriculture, construction, and public safety are increasingly integrating drone technology into their operations. For instance, electric drones are being utilized for crop monitoring, infrastructure inspections, and emergency response, showcasing their versatility. The electric drone market is expected to benefit from this diversification, as businesses recognize the efficiency and cost-effectiveness of drone solutions. As new use cases emerge, the market is likely to see an influx of innovative applications, further solidifying the role of electric drones in various sectors.

Advancements in Battery Technology

Battery technology advancements are playing a crucial role in the electric drone market. Enhanced battery efficiency and energy density are enabling longer flight times and greater payload capacities. Recent innovations have led to batteries that can provide up to 50% more energy storage, significantly extending operational ranges. This is particularly relevant for commercial applications, where longer flight durations can translate into increased productivity. The electric drone market is likely to benefit from these technological improvements, as they allow for more versatile applications, including agricultural monitoring and infrastructure inspection. As battery technology continues to evolve, it is expected to further drive the adoption of electric drones across various sectors.

Growing Demand for Delivery Services

The electric drone market is experiencing a notable surge in demand for delivery services, particularly in urban areas. As e-commerce continues to expand, companies are increasingly exploring drone technology to enhance logistics efficiency. According to recent data, the market for drone delivery services is projected to reach approximately $29 billion by 2027 in the US. This growth is driven by the need for faster delivery times and reduced operational costs. Electric drones offer a sustainable alternative to traditional delivery methods, appealing to environmentally conscious consumers. The electric drone market is thus positioned to capitalize on this trend, as businesses seek innovative solutions to meet consumer expectations and improve service delivery.

Increased Investment in Drone Technology

Investment in drone technology is witnessing a substantial increase, which is positively impacting the electric drone market. Venture capital funding for drone startups has surged, with estimates indicating that investments could exceed $5 billion by 2026 in the US. This influx of capital is facilitating research and development, leading to innovative solutions and improved drone capabilities. The electric drone market is likely to see a proliferation of new entrants and enhanced competition, fostering an environment ripe for technological breakthroughs. As investors recognize the potential of electric drones in various applications, from agriculture to surveillance, the market is expected to expand significantly.