Advancements in Drone Technology

Technological advancements in drone capabilities are pivotal to the growth of the drone telematics market. Innovations such as enhanced battery life, improved sensors, and advanced navigation systems enable drones to perform complex tasks more efficiently. For example, drones equipped with high-resolution cameras and LiDAR technology can gather detailed data for mapping and surveying applications. The market for drone telematics is projected to expand as these technological improvements enhance the functionality and reliability of drones. As a result, industries are increasingly investing in telematics solutions to leverage these advancements, potentially leading to a market growth rate of over 15% annually.

Growing Demand for Real-Time Data

The drone telematics market experiences a notable surge in demand for real-time data analytics. Industries such as logistics, agriculture, and construction increasingly rely on immediate insights to enhance operational efficiency. For instance, the logistics sector utilizes drone telematics to monitor fleet movements, leading to a potential reduction in delivery times by up to 30%. This demand for instantaneous data is likely to drive investments in advanced telematics solutions, as businesses seek to optimize their processes and improve decision-making. The integration of real-time data capabilities into drone telematics systems appears to be a critical factor in the market's growth trajectory.

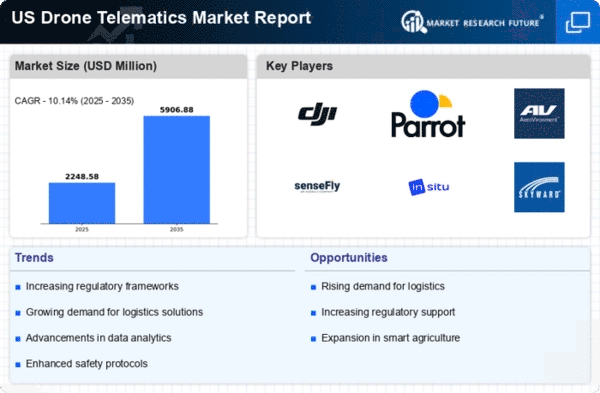

Regulatory Support and Frameworks

The establishment of supportive regulatory frameworks significantly influences the drone telematics market. In the US, the Federal Aviation Administration (FAA) has implemented regulations that facilitate the safe integration of drones into national airspace. This regulatory clarity encourages businesses to adopt drone telematics solutions, as compliance becomes more manageable. Furthermore, the FAA's initiatives to promote drone usage in various sectors, including agriculture and infrastructure inspection, suggest a growing acceptance of drone technology. As regulations evolve, the drone telematics market is likely to benefit from increased adoption and innovation, fostering a more robust industry landscape.

Increased Investment in Infrastructure

The drone telematics market is likely to benefit from increased investment in infrastructure development across the US. As cities and states allocate substantial budgets for infrastructure projects, the demand for drones equipped with telematics systems rises. These drones facilitate efficient monitoring and inspection of construction sites, ensuring compliance with safety standards and project timelines. The market could see a significant uptick, with estimates suggesting that infrastructure spending is expected to reach $1 trillion by 2027. This investment creates opportunities for drone telematics providers to offer tailored solutions that enhance project management and operational oversight.

Rising Interest in Environmental Monitoring

The growing emphasis on environmental sustainability drives interest in the drone telematics market. Organizations are increasingly utilizing drones for environmental monitoring, including wildlife tracking, pollution assessment, and land use analysis. The ability to collect and analyze data from remote locations enhances the effectiveness of conservation efforts. As environmental regulations become more stringent, the demand for drone telematics solutions that support compliance and reporting is likely to increase. This trend suggests a promising avenue for growth within the market, as stakeholders seek innovative ways to address environmental challenges.