Increased Focus on Home Security

The US DIY Smart Home Market is witnessing a heightened focus on home security solutions. With rising concerns about safety and property protection, consumers are increasingly investing in smart security systems, including cameras, alarms, and smart locks. Recent statistics reveal that nearly 40% of US households have implemented some form of smart security technology. This trend is driven by the desire for enhanced surveillance and remote monitoring capabilities, allowing homeowners to keep an eye on their properties from anywhere. As technology evolves, the availability of affordable and user-friendly security solutions is expanding, making it easier for consumers to enhance their home security. This growing emphasis on safety is likely to further stimulate the US DIY Smart Home Market.

Growing Demand for Home Automation

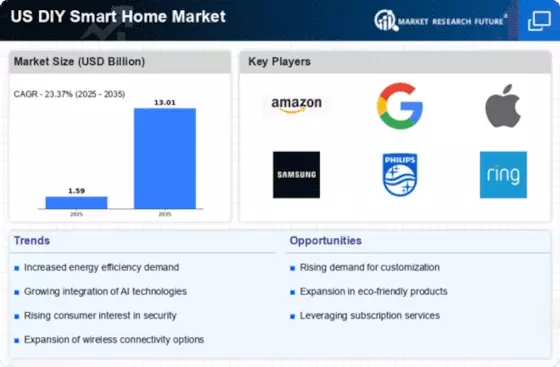

The US DIY Smart Home Market is experiencing a notable surge in demand for home automation solutions. Consumers are increasingly seeking ways to enhance convenience and security within their homes. According to recent data, approximately 30% of US households have adopted at least one smart home device, indicating a growing trend towards automation. This demand is driven by the desire for seamless control over home systems, such as lighting, heating, and security, through mobile applications. As technology advances, the availability of user-friendly DIY smart home products continues to expand, making it easier for consumers to integrate these solutions into their daily lives. This trend suggests that the US DIY Smart Home Market will likely continue to grow as more individuals recognize the benefits of home automation.

Rising Awareness of Energy Efficiency

In the US DIY Smart Home Market, there is an increasing awareness of energy efficiency among consumers. Many individuals are motivated to adopt smart home technologies that can help reduce energy consumption and lower utility bills. For instance, smart thermostats and energy monitoring systems allow homeowners to optimize their energy usage effectively. Data indicates that homes equipped with smart energy management systems can achieve energy savings of up to 20%. This growing focus on sustainability aligns with broader environmental goals and government initiatives aimed at promoting energy-efficient practices. As consumers become more environmentally conscious, the demand for energy-efficient smart home solutions is expected to rise, further propelling the US DIY Smart Home Market.

Advancements in Connectivity Technologies

The US DIY Smart Home Market is significantly influenced by advancements in connectivity technologies. The proliferation of high-speed internet and the expansion of wireless communication protocols, such as Wi-Fi and Zigbee, have facilitated the seamless integration of smart devices. This enhanced connectivity allows consumers to control multiple devices from a single platform, improving user experience and functionality. As of January 2026, it is estimated that over 50% of smart home devices in the US are connected to the internet, enabling real-time monitoring and control. This trend indicates that as connectivity continues to improve, the US DIY Smart Home Market will likely see increased adoption rates, as consumers seek more integrated and efficient solutions for their homes.

Expansion of Retail Channels and Online Platforms

The US DIY Smart Home Market is benefiting from the expansion of retail channels and online platforms. As more consumers turn to e-commerce for their shopping needs, the availability of smart home products has increased significantly. Major retailers and specialized online platforms are now offering a wide range of DIY smart home solutions, making it easier for consumers to access these technologies. This trend is supported by data indicating that online sales of smart home devices have grown by over 25% in the past year. The convenience of online shopping, combined with the ability to compare products and read reviews, is likely to drive further growth in the US DIY Smart Home Market. As consumers become more comfortable with purchasing smart home technologies online, the market is expected to expand.