Rising Prevalence of Diabetes

The increasing incidence of diabetes in the US is a primary driver for the diabetic neuropathy-treatment market. According to the Centers for Disease Control and Prevention (CDC), approximately 34.2 million people in the US have diabetes, which translates to about 10.5% of the population. This growing diabetic population is likely to experience complications such as neuropathy, thereby escalating the demand for effective treatment options. As the prevalence of diabetes continues to rise, healthcare providers are focusing on developing and implementing targeted therapies to manage diabetic neuropathy. This trend suggests that the diabetic neuropathy-treatment market will expand significantly, as more patients seek interventions to alleviate their symptoms and improve their quality of life.

Increased Awareness and Education

Growing awareness and education regarding diabetic neuropathy are influencing the diabetic neuropathy-treatment market positively. Healthcare organizations and advocacy groups are actively promoting information about the risks and symptoms associated with diabetic neuropathy. This heightened awareness encourages patients to seek early diagnosis and treatment, which is crucial for effective management. As patients become more informed about their condition, the demand for specialized treatments is expected to rise. Consequently, healthcare providers are likely to expand their offerings in the diabetic neuropathy-treatment market, ensuring that patients have access to the latest therapies and management strategies.

Advancements in Pharmaceutical Research

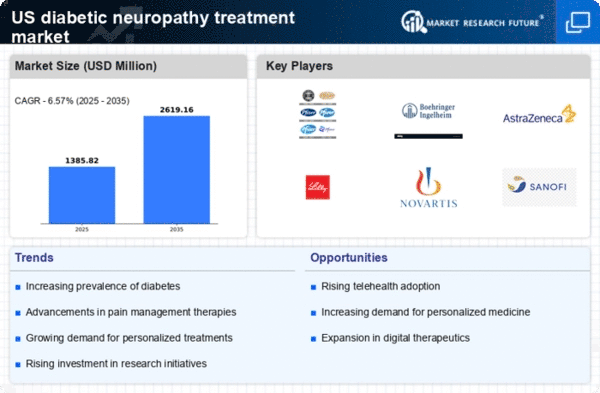

Innovations in pharmaceutical research are propelling the diabetic neuropathy-treatment market forward. Recent developments in drug formulations and delivery systems have led to the introduction of novel therapies that target neuropathic pain more effectively. For instance, medications such as pregabalin and duloxetine have gained traction due to their efficacy in managing diabetic neuropathy symptoms. The market is projected to witness a compound annual growth rate (CAGR) of around 6.5% over the next few years, driven by these advancements. Furthermore, ongoing clinical trials and research initiatives are likely to yield new treatment options, enhancing the overall landscape of the diabetic neuropathy-treatment market.

Aging Population and Associated Health Issues

The aging population in the US is a significant driver of the diabetic neuropathy-treatment market. As individuals age, the risk of developing diabetes and its complications, including neuropathy, increases. The US Census Bureau projects that by 2030, approximately 20% of the population will be 65 years or older. This demographic shift is likely to result in a higher prevalence of diabetic neuropathy, thereby increasing the demand for effective treatment options. Healthcare systems are expected to adapt to this growing need by enhancing their services and expanding the diabetic neuropathy-treatment market to cater to the aging population.

Technological Innovations in Treatment Delivery

Technological advancements in treatment delivery methods are reshaping the diabetic neuropathy-treatment market. Innovations such as wearable devices and mobile health applications are enabling patients to monitor their symptoms and manage their conditions more effectively. These technologies facilitate real-time data collection and personalized treatment adjustments, which can enhance patient outcomes. As the healthcare landscape continues to evolve, the integration of technology into treatment protocols is expected to drive growth in the diabetic neuropathy-treatment market. This trend indicates a shift towards more patient-centered care, where technology plays a pivotal role in managing diabetic neuropathy.