Health and Wellness Trends

The dairy packaging market is significantly influenced by the increasing consumer focus on health and wellness. As individuals become more health-conscious, there is a growing demand for dairy products that are perceived as nutritious and beneficial. This trend has led to a rise in the popularity of organic and low-fat dairy options, which are often packaged in ways that highlight their health benefits. For instance, products labeled as 'high in protein' or 'rich in calcium' are gaining traction, with sales in these categories increasing by around 20% in recent years. The packaging plays a crucial role in conveying these health messages, as consumers often rely on labels to make informed choices. Consequently, the dairy packaging market is evolving to incorporate clear nutritional information and appealing designs that resonate with health-oriented consumers, thereby driving market growth.

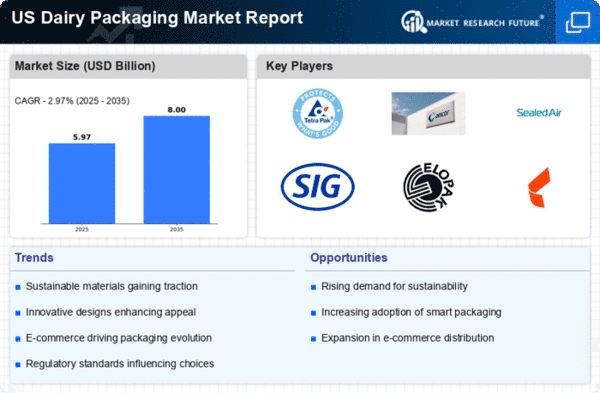

Sustainability Initiatives

Sustainability initiatives are becoming increasingly prominent within the dairy packaging market, as consumers and companies alike prioritize environmentally friendly practices. The push for sustainable packaging solutions is driven by a growing awareness of environmental issues and a desire to reduce plastic waste. Many dairy brands are now exploring biodegradable and recyclable materials, which are gaining traction among eco-conscious consumers. Recent studies indicate that approximately 60% of consumers are willing to pay more for products with sustainable packaging. This shift is prompting manufacturers to invest in research and development to create innovative packaging solutions that align with sustainability goals. As a result, the dairy packaging market is likely to see a significant transformation, with an emphasis on reducing the carbon footprint and promoting circular economy practices.

Rising Demand for Convenience Foods

The dairy packaging market is experiencing a notable surge in demand for convenience foods, driven by changing consumer lifestyles. As more individuals seek quick and easy meal solutions, dairy products packaged for on-the-go consumption are becoming increasingly popular. This trend is reflected in the growth of single-serve yogurt and cheese products, which have seen a rise in sales by approximately 15% over the past year. The convenience factor not only appeals to busy consumers but also encourages impulse purchases, thereby boosting overall market growth. Furthermore, the dairy packaging market is adapting to this trend by innovating packaging designs that enhance portability and ease of use, ensuring that products remain fresh and appealing. This shift towards convenience is likely to continue influencing packaging strategies in the dairy sector, as manufacturers strive to meet evolving consumer preferences.

Technological Advancements in Packaging

Technological advancements are reshaping the dairy packaging market, offering innovative solutions that enhance product preservation and consumer engagement. The introduction of advanced materials and smart packaging technologies is enabling manufacturers to improve shelf life and maintain product quality. For example, the use of vacuum sealing and modified atmosphere packaging has been shown to extend the freshness of dairy products, reducing waste and increasing consumer satisfaction. Additionally, the integration of QR codes and augmented reality features in packaging allows brands to connect with consumers on a deeper level, providing information about sourcing and production processes. This technological evolution not only meets consumer demands for transparency but also positions brands favorably in a competitive market. As these technologies continue to develop, they are likely to play a pivotal role in shaping the future of the dairy packaging market.

E-commerce Growth and Packaging Adaptation

The rapid growth of e-commerce is significantly impacting the dairy packaging market, necessitating adaptations in packaging design and functionality. As online grocery shopping becomes more prevalent, dairy products must be packaged to withstand the rigors of shipping while ensuring product integrity. This has led to innovations in packaging materials that provide better insulation and protection during transit. For instance, the use of insulated boxes and temperature-controlled packaging solutions is becoming more common, ensuring that dairy products remain fresh upon delivery. Additionally, the packaging must be user-friendly, allowing consumers to easily open and reseal products. The dairy packaging market is thus evolving to meet the demands of e-commerce, with a focus on creating packaging that enhances the overall consumer experience while maintaining product quality.