Evolving Regulatory Landscape

The dairy ingredients market is navigating an evolving regulatory landscape that impacts product formulation and labeling. Regulatory bodies are increasingly scrutinizing food safety and labeling practices, which influences how dairy ingredients are produced and marketed. Compliance with these regulations is essential for manufacturers to maintain consumer trust and market access. Recent changes in labeling requirements, particularly concerning health claims and ingredient transparency, are prompting companies to adapt their strategies. This evolving regulatory environment may lead to increased costs for compliance, but it also presents opportunities for innovation in product development. As manufacturers align with regulatory expectations, the dairy ingredients market is likely to see a shift towards greater transparency and quality assurance.

Increased Focus on Nutritional Value

The dairy ingredients market is witnessing a growing emphasis on the nutritional profiles of products. Consumers are becoming more discerning about the health benefits associated with dairy ingredients, such as protein content, vitamins, and minerals. This trend is particularly evident in the sports nutrition segment, where high-protein dairy ingredients are in demand. Recent statistics indicate that the protein-enriched dairy segment is expected to grow by 12% over the next five years. Manufacturers are responding by enhancing the nutritional value of their products, which may include fortifying dairy ingredients with additional nutrients. This focus on nutrition is likely to drive innovation within the dairy ingredients market, as companies strive to meet the evolving expectations of health-conscious consumers.

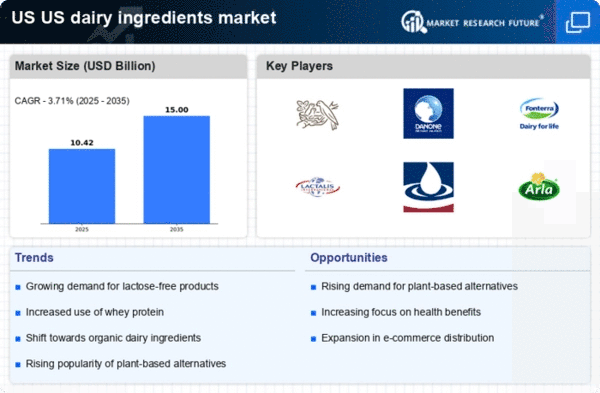

Expansion of Plant-Based Alternatives

The rise of plant-based diets is impacting the dairy ingredients market, as consumers increasingly seek alternatives to traditional dairy products. This trend is not only driven by dietary preferences but also by environmental concerns and lactose intolerance. The market for dairy alternatives, such as almond and oat milk, is projected to grow at a rate of 10% annually. Consequently, dairy ingredient manufacturers are exploring ways to incorporate plant-based components into their offerings. This expansion may lead to innovative product formulations that blend traditional dairy with plant-based ingredients, thereby appealing to a broader consumer base. The dairy ingredients market is thus adapting to this shift, potentially redefining its product landscape.

Rising Popularity of Functional Foods

The dairy ingredients market is increasingly influenced by the popularity of functional foods, which are designed to provide health benefits beyond basic nutrition. Consumers are actively seeking dairy ingredients that offer functional properties, such as probiotics for gut health or omega-3 fatty acids for heart health. This trend is supported by research indicating that the functional food market is projected to grow by 9% annually. As a result, dairy ingredient manufacturers are investing in research and development to create products that meet these consumer demands. The integration of functional ingredients into dairy products is likely to enhance their appeal, thereby driving growth in the dairy ingredients market.

Growing Demand for Natural Ingredients

The dairy ingredients market is experiencing a notable shift towards natural and clean-label products. Consumers are increasingly seeking dairy ingredients that are minimally processed and free from artificial additives. This trend is driven by a heightened awareness of health and wellness, with many consumers preferring products that align with their dietary preferences. According to recent data, the demand for natural dairy ingredients has surged, with a projected growth rate of approximately 8% annually. This shift is influencing manufacturers to reformulate their products, thereby expanding the range of natural dairy ingredients available in the market. As a result, the dairy ingredients market is likely to see a significant transformation, catering to the evolving preferences of health-conscious consumers.