Emergence of 5G Technology

The rollout of 5G technology is poised to revolutionize the csp network-analytics market. With its promise of ultra-fast data speeds and low latency, 5G is expected to generate vast amounts of data that require sophisticated analytics for effective management. Telecommunications providers are investing heavily in analytics solutions to harness the potential of 5G networks, which could lead to a market expansion of approximately 25% by 2027. This technological advancement necessitates the development of new analytics capabilities to monitor network performance and optimize user experiences. As a result, the csp network-analytics market is likely to evolve rapidly in response to the demands of 5G.

Adoption of Cloud-Based Solutions

The shift towards cloud-based solutions is a pivotal driver in the csp network-analytics market. As organizations increasingly migrate their operations to the cloud, the demand for analytics tools that can seamlessly integrate with cloud infrastructure is rising. This transition allows for greater scalability, flexibility, and cost-effectiveness in data management. In 2025, the cloud-based analytics segment is anticipated to account for over 40% of the total market share, reflecting a significant trend towards digital transformation. The ability to access real-time data and insights from anywhere enhances decision-making processes, thereby propelling the growth of the csp network-analytics market.

Increased Focus on Customer Experience

In the csp network-analytics market, there is a growing emphasis on enhancing customer experience through data analytics. Service providers are recognizing that understanding customer behavior and preferences is crucial for retaining subscribers and reducing churn rates. By utilizing advanced analytics, companies can tailor their services to meet specific customer needs, thereby improving satisfaction levels. Reports suggest that organizations that effectively leverage analytics can achieve up to a 20% increase in customer retention. This focus on customer-centric strategies is propelling the demand for analytics solutions, as businesses aim to create personalized experiences that foster loyalty and engagement.

Rising Demand for Network Optimization

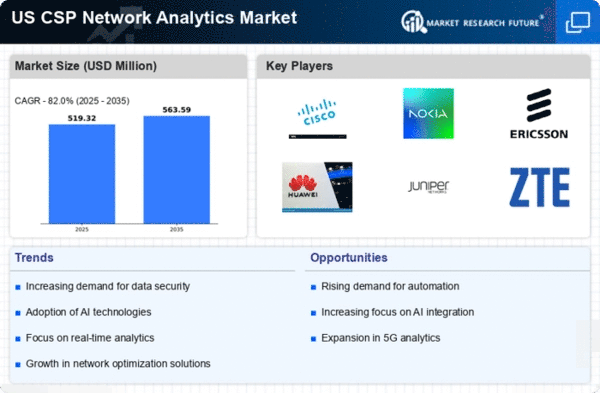

The csp network-analytics market is experiencing a notable surge in demand for network optimization solutions. As telecommunications companies strive to enhance service quality and reduce operational costs, analytics tools that provide insights into network performance are becoming essential. In 2025, the market is projected to reach approximately $3 billion, driven by the need for efficient bandwidth management and improved customer experiences. This trend indicates that service providers are increasingly investing in analytics to identify bottlenecks and optimize resource allocation. Consequently, The CSP network-analytics market is likely to witness robust growth. Organizations are seeking to leverage data-driven strategies to enhance their network infrastructure.

Regulatory Compliance and Reporting Needs

The CSP network-analytics market is significantly influenced by increasing regulatory compliance requirements. These requirements are imposed on telecommunications providers. As regulations surrounding data privacy and security become more stringent, companies are compelled to adopt analytics solutions that ensure compliance with legal standards. This trend is particularly evident in the US, where regulatory bodies are enforcing guidelines that necessitate transparent reporting and data management practices. The market for compliance-driven analytics is expected to grow, with estimates suggesting a potential increase of 15% in demand for such solutions by 2026. This regulatory landscape is shaping the csp network-analytics market, as organizations prioritize compliance alongside operational efficiency.