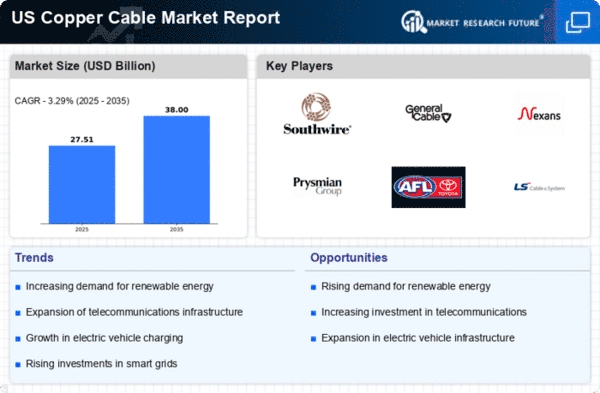

The copper cable market is currently characterized by a competitive landscape that is both dynamic and multifaceted. Key growth drivers include the increasing demand for high-speed data transmission, the expansion of renewable energy projects, and the ongoing infrastructure upgrades across various sectors. Major players such as Southwire Company (US), General Cable (US), and Prysmian Group (IT) are strategically positioned to leverage these trends. Southwire Company (US) focuses on innovation in product development, particularly in sustainable cable solutions, while General Cable (US) emphasizes regional expansion to enhance its market presence. Prysmian Group (IT), on the other hand, is heavily investing in digital transformation initiatives to optimize its operations and improve customer engagement. Collectively, these strategies contribute to a competitive environment that is increasingly shaped by technological advancements and sustainability initiatives.In terms of business tactics, companies are localizing manufacturing to reduce lead times and enhance supply chain efficiency. This approach is particularly relevant in a moderately fragmented market where several players vie for market share. The collective influence of key players is significant, as they not only drive innovation but also set industry standards that smaller competitors often follow. The competitive structure is evolving, with larger firms increasingly dominating the landscape through strategic partnerships and acquisitions.

In October Southwire Company (US) announced a partnership with a leading renewable energy firm to develop specialized copper cables for solar energy applications. This strategic move is likely to enhance Southwire's product offerings in the growing renewable sector, positioning the company as a key player in sustainable energy solutions. The collaboration underscores the importance of aligning product development with market demands, particularly in the context of increasing environmental regulations.

In September General Cable (US) completed the acquisition of a regional competitor, which is expected to bolster its manufacturing capabilities and expand its distribution network. This acquisition not only strengthens General Cable's market position but also allows for greater economies of scale, potentially leading to improved pricing strategies. The move reflects a broader trend of consolidation within the industry, as companies seek to enhance their competitive edge through increased operational efficiency.

In August Prysmian Group (IT) launched a new line of high-performance copper cables designed for data centers, emphasizing energy efficiency and reduced environmental impact. This product launch is indicative of the company's commitment to innovation and sustainability, aligning with current market trends that prioritize energy-efficient solutions. The introduction of such products is likely to attract a growing customer base focused on reducing their carbon footprint.

As of November the competitive trends in the copper cable market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate in order to stay ahead in a rapidly evolving market. Looking forward, competitive differentiation is expected to shift from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This evolution suggests that companies that prioritize these areas will likely emerge as leaders in the copper cable market.