Rising Healthcare Expenditure

The increasing healthcare expenditure in the US is a significant driver for the compression therapy market. With healthcare spending projected to reach $6 trillion by 2027, there is a growing focus on preventive care and management of chronic conditions. Compression therapy is often viewed as a cost-effective intervention that can reduce the need for more invasive procedures, thereby appealing to both patients and healthcare providers. The emphasis on value-based care is likely to encourage the adoption of compression therapy as a standard treatment option for various conditions. This trend indicates that as healthcare budgets expand, there will be more resources allocated to therapies that improve patient quality of life, further propelling the compression therapy market.

Advancements in Compression Technology

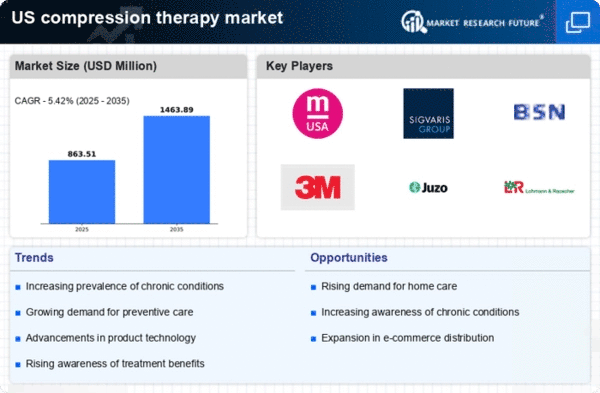

Innovations in compression technology are transforming the compression therapy market. The introduction of smart textiles and wearable devices that monitor patient compliance and provide real-time feedback is gaining traction. These advancements not only improve patient outcomes but also enhance the overall effectiveness of compression therapy. For instance, the integration of sensors in compression garments allows for personalized treatment plans, which can lead to better adherence and improved results. The market for these advanced products is projected to grow, with estimates suggesting a compound annual growth rate (CAGR) of around 8% over the next five years. As healthcare providers and patients alike recognize the benefits of these technological advancements, the compression therapy market is likely to experience a surge in demand.

Increased Focus on Preventive Healthcare

The shift towards preventive healthcare is influencing the compression therapy market positively. As healthcare systems emphasize early intervention and management of chronic conditions, compression therapy is increasingly recognized for its role in preventing complications associated with venous disorders. This proactive approach aligns with the broader healthcare trend of reducing long-term costs associated with untreated conditions. The market is likely to benefit from initiatives aimed at educating both healthcare professionals and patients about the advantages of compression therapy. Furthermore, insurance coverage for preventive treatments is expanding, which may enhance accessibility and affordability for patients. This focus on prevention could lead to a substantial increase in the adoption of compression therapy solutions.

Growing Demand for Non-Invasive Treatment Options

The rising preference for non-invasive treatment options is a notable driver for the compression therapy market. Patients are increasingly seeking alternatives to surgical interventions due to concerns about recovery times, complications, and costs. Compression therapy offers a viable solution that is both effective and less invasive, making it an attractive option for managing various conditions. The market is witnessing a shift as more healthcare providers recommend compression garments as first-line treatments for venous disorders. This trend is likely to continue, with a growing body of evidence supporting the efficacy of compression therapy. As patient awareness increases and the healthcare landscape evolves, the demand for non-invasive therapies, including compression therapy, is expected to rise.

Increasing Prevalence of Chronic Venous Disorders

The rising incidence of chronic venous disorders, such as varicose veins and chronic venous insufficiency, is a primary driver for the compression therapy market. According to recent data, approximately 25 million adults in the US are affected by chronic venous diseases, leading to a growing demand for effective treatment options. Compression therapy is recognized as a non-invasive and cost-effective solution for managing these conditions. As healthcare providers increasingly recommend compression garments, the market is expected to expand significantly. The increasing prevalence of obesity and sedentary lifestyles further exacerbates these disorders, indicating a potential growth trajectory for the compression therapy market. This trend suggests that healthcare systems may need to allocate more resources towards managing venous health, thereby enhancing the market's potential.