Rising Incidence of Sports Injuries

The cold pain-therapy market is significantly influenced by the rising incidence of sports injuries across various demographics. As participation in sports and physical activities increases, so does the occurrence of injuries such as sprains, strains, and muscle tears. The American Orthopaedic Society for Sports Medicine reports that sports injuries account for nearly 3.5 million injuries annually in the US. Consequently, athletes and active individuals are increasingly turning to cold therapy as a primary method for immediate pain relief and recovery. This trend is expected to bolster the cold pain-therapy market, as more consumers seek effective solutions to manage sports-related injuries.

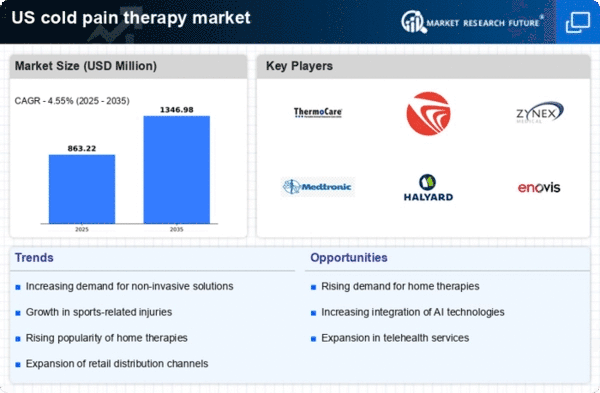

Expansion of Retail Distribution Channels

The cold pain-therapy market is benefiting from the expansion of retail distribution channels, which enhances product accessibility for consumers. Major retailers and e-commerce platforms are increasingly stocking a variety of cold therapy products, including ice packs, cold wraps, and cryotherapy devices. This increased availability is likely to attract a broader customer base, including those who may not have previously considered cold therapy for pain management. Recent data indicates that online sales of cold therapy products have grown by 40% in the past year, reflecting a shift in consumer purchasing behavior. This trend suggests that improved distribution channels will continue to drive market growth.

Growing Awareness of Cold Therapy Benefits

The cold pain-therapy market is experiencing a surge in consumer awareness regarding the benefits of cold therapy for pain management. Educational campaigns and health initiatives have highlighted the efficacy of cold therapy in reducing inflammation and alleviating pain. This increased awareness is likely to drive demand for cold therapy products, as individuals seek non-invasive solutions for pain relief. According to recent surveys, approximately 65% of consumers are now aware of the advantages of cold therapy, which is a notable increase from previous years. This trend suggests a shift in consumer preferences towards cold pain-therapy solutions, thereby positively impacting the market's growth trajectory.

Technological Advancements in Cold Therapy Devices

The cold pain-therapy market is poised for growth due to technological advancements in cold therapy devices. Innovations such as portable cryotherapy units and smart ice packs equipped with temperature control features are becoming increasingly popular among consumers. These advancements not only enhance the effectiveness of cold therapy but also improve user convenience and comfort. Market Research Future indicates that the adoption of technologically advanced cold therapy devices has increased by 30% over the past year. This trend suggests that consumers are willing to invest in high-quality, innovative products that offer superior pain relief solutions, thereby driving the overall growth of the cold pain-therapy market.

Integration of Cold Therapy in Rehabilitation Programs

There is a trend towards the integration of cold therapy into rehabilitation programs for various medical conditions. Healthcare professionals are increasingly recommending cold therapy as part of comprehensive treatment plans for patients recovering from surgeries, injuries, or chronic pain conditions. This integration is supported by clinical evidence demonstrating the effectiveness of cold therapy in reducing pain and promoting healing. As rehabilitation programs evolve, the demand for cold therapy products is likely to increase, positioning the market for sustained growth. The collaboration between healthcare providers and cold therapy manufacturers may further enhance product development and consumer trust.