Regulatory Compliance and Data Governance

The cloud object-storage market is significantly influenced by the need for regulatory compliance and data governance. Organizations are increasingly required to adhere to stringent regulations regarding data protection and privacy, such as the CCPA and GDPR. Compliance with these regulations necessitates robust data management practices, which cloud object-storage solutions can provide. Companies are investing in storage systems that offer advanced security features, including encryption and access controls, to ensure compliance with legal requirements. This focus on regulatory compliance is likely to drive growth in the cloud object-storage market, as businesses seek solutions that not only meet their storage needs but also align with regulatory standards. The ability to demonstrate compliance can enhance an organization's reputation and build trust with customers, further incentivizing the adoption of cloud object-storage solutions.

Shift Towards Cost-Effective Data Management

Cost management remains a critical focus for organizations in the cloud object-storage market. As businesses seek to optimize their IT budgets, the shift towards cost-effective data management solutions is becoming increasingly pronounced. According to recent data, organizations can save up to 40% on storage costs by migrating to cloud object-storage systems compared to traditional on-premises solutions. This financial incentive is compelling many companies to adopt cloud-based storage, as it not only reduces capital expenditures but also minimizes ongoing maintenance costs. Furthermore, the pay-as-you-go pricing model offered by many cloud providers allows businesses to align their storage expenses with actual usage, enhancing financial predictability. This trend towards cost-effective data management is likely to continue shaping the cloud object-storage market, as organizations prioritize budget-friendly solutions that do not compromise on performance.

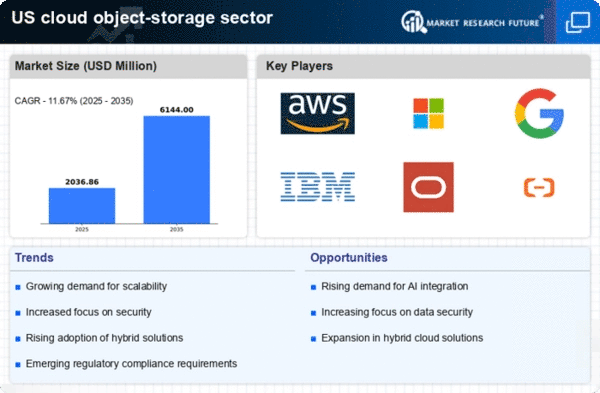

Growing Demand for Scalable Storage Solutions

The cloud object-storage market is experiencing a notable surge in demand for scalable storage solutions. As organizations increasingly generate vast amounts of data, the need for flexible storage options becomes paramount. This trend is particularly evident in sectors such as healthcare and finance, where data volumes are projected to grow by over 30% annually. Companies are seeking cloud object-storage solutions that can seamlessly scale to accommodate their expanding data needs without incurring prohibitive costs. The ability to dynamically adjust storage capacity allows businesses to optimize their operational efficiency while managing expenses effectively. This growing demand for scalable solutions is likely to drive innovation and competition within the cloud object-storage market, as providers strive to offer more robust and adaptable services to meet customer requirements.

Increased Focus on Data Accessibility and Collaboration

In the cloud object-storage market, the emphasis on data accessibility and collaboration is becoming increasingly vital. Organizations are recognizing the importance of enabling their teams to access and share data seamlessly, regardless of location. This trend is particularly relevant in industries such as technology and media, where collaboration is essential for innovation and productivity. Cloud object-storage solutions facilitate real-time data sharing and collaboration, allowing teams to work together more effectively. As remote work becomes more prevalent, the demand for accessible storage solutions is likely to grow. Companies are investing in cloud object-storage systems that support collaborative workflows, which may enhance overall operational efficiency. This increased focus on data accessibility and collaboration is expected to drive further adoption of cloud object-storage solutions across various sectors.

Emergence of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies is poised to transform the cloud object-storage market. These advanced technologies enable organizations to analyze vast amounts of data more efficiently, unlocking valuable insights that can drive decision-making. As AI and ML applications become more prevalent, the demand for cloud object-storage solutions that can support these technologies is likely to increase. Companies are seeking storage systems that can handle the high data throughput required for AI and ML workloads, which may lead to innovations in storage architecture. Furthermore, the ability to leverage AI and ML for data management can enhance operational efficiency and reduce costs. This emergence of AI and ML in the cloud object-storage market suggests a future where intelligent storage solutions become the norm, driving further advancements in the industry.