Growth in Biopharmaceuticals

The chiral chromatography-columns market is significantly influenced by the expansion of the biopharmaceutical sector. With the increasing prevalence of biologics and biosimilars, there is a heightened requirement for effective separation techniques to ensure the purity and quality of these products. The biopharmaceutical market in the US is expected to surpass $300 billion by 2025, which will likely drive the demand for chiral chromatography-columns. These columns are crucial for the analysis and purification of chiral compounds, thereby supporting the development of innovative therapies. As biopharmaceutical companies continue to invest in research and development, the chiral chromatography-columns market is poised for substantial growth.

Increased Focus on Quality Control

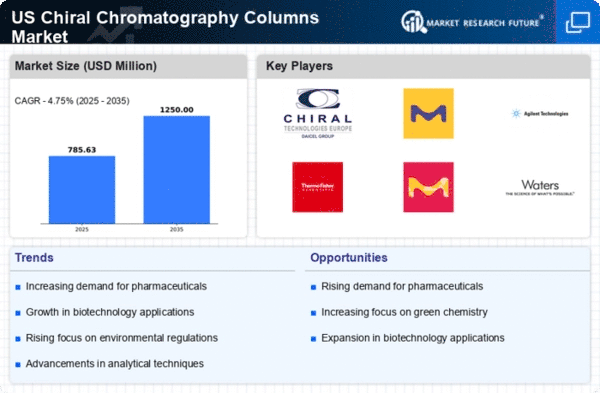

The chiral chromatography-columns market is benefiting from an increased emphasis on quality control across multiple industries. Regulatory bodies are imposing stricter guidelines regarding the purity and safety of products, particularly in pharmaceuticals and food. This heightened focus on compliance is driving manufacturers to adopt advanced separation techniques, including chiral chromatography. As companies strive to meet these regulatory requirements, the demand for chiral chromatography-columns is expected to rise. The market is likely to see a compound annual growth rate (CAGR) of around 5% through 2025, reflecting the growing importance of quality assurance in product development and manufacturing.

Technological Innovations in Chromatography

Technological advancements in chromatography are playing a pivotal role in shaping the chiral chromatography-columns market. Innovations such as the development of new stationary phases and improved column designs are enhancing the efficiency and resolution of chiral separations. These advancements are crucial for meeting the evolving needs of various industries, including pharmaceuticals and food safety. The introduction of high-performance liquid chromatography (HPLC) systems has also contributed to the growth of the market, as they offer faster analysis times and greater sensitivity. As these technologies continue to evolve, they are likely to drive further investment in the chiral chromatography-columns market, fostering a competitive landscape.

Rising Demand in Pharmaceutical Applications

The chiral chromatography-columns market is experiencing a notable surge in demand, particularly within the pharmaceutical sector. This is largely driven by the increasing need for the separation of enantiomers in drug development and production. As pharmaceutical companies strive to enhance the efficacy and safety of their products, the utilization of chiral chromatography becomes essential. In 2025, the pharmaceutical industry in the US is projected to reach approximately $600 billion, with a significant portion allocated to chiral separation technologies. This trend indicates a robust growth trajectory for the chiral chromatography-columns market, as more companies recognize the importance of chiral purity in their formulations.

Emerging Applications in Food and Beverage Industry

The chiral chromatography-columns market is expanding into the food and beverage industry, where the need for quality control and safety testing is paramount. As consumers become more health-conscious, food manufacturers are increasingly required to ensure the purity of their products, particularly in the case of chiral compounds. The market for food testing is projected to grow at a CAGR of around 7% through 2025, which may lead to increased adoption of chiral chromatography techniques. This trend suggests that the chiral chromatography-columns market will benefit from the rising demand for accurate and reliable testing methods in food safety and quality assurance.