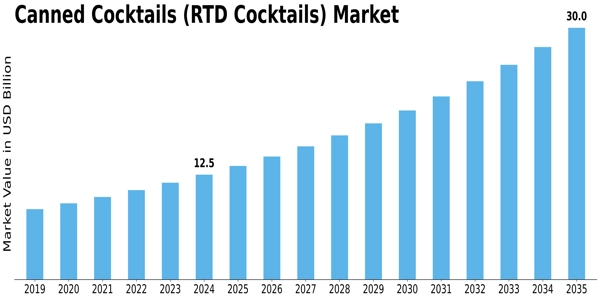

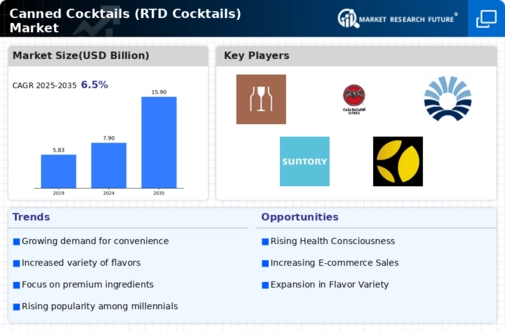

Us Canned Cocktails Rtd Cocktails Size

US Canned Cocktails (RTD Cocktails) Market Growth Projections and Opportunities

The US canned cocktails, or ready-to-drink (RTD) cocktails, market is influenced by several key factors that shape its growth, trends, and consumer demand. One significant factor is the changing consumer lifestyle and preferences. As more people seek convenient and portable beverage options for social gatherings, outdoor activities, and on-the-go consumption, canned cocktails offer a convenient solution. These pre-mixed cocktails in a can provide consumers with the convenience of enjoying their favorite cocktails without the need for specialized ingredients, equipment, or bartending skills, catering to the fast-paced lifestyle of modern consumers.

Changing drinking habits and the desire for premium experiences also drive the US canned cocktails market. With an increasing number of consumers looking for high-quality cocktails outside of traditional bar settings, there's a growing demand for premium RTD cocktails made with premium spirits and natural ingredients. Canned cocktails crafted by experienced mixologists or renowned brands offer consumers the assurance of consistent quality and flavor, appealing to those seeking a premium drinking experience without the hassle of mixing drinks from scratch.

The influence of convenience and portability is another significant market factor in the US canned cocktails industry. Canned cocktails provide a convenient and portable alternative to traditional bottled cocktails or homemade mixes, allowing consumers to enjoy their favorite drinks anytime, anywhere. Whether at a picnic, beach outing, or outdoor concert, canned cocktails are easy to transport, store, and consume, making them ideal for outdoor and social occasions where glassware and bar accessories may be impractical or prohibited.

Marketing and branding strategies play a crucial role in shaping consumer perceptions and driving demand in the US canned cocktails market. Companies invest in creative packaging, branding, and marketing campaigns to differentiate their products and stand out on store shelves. Eye-catching labels, vibrant designs, and compelling brand stories help attract consumers' attention and communicate the unique flavor profiles and premium ingredients of canned cocktails. Moreover, engaging consumers through social media, influencer partnerships, and experiential marketing events helps build brand awareness and foster consumer loyalty.

Distribution channels also impact the US canned cocktails market, influencing accessibility and consumer reach. While canned cocktails were once primarily sold through liquor stores or specialty retailers, they have now become more mainstream, with supermarkets, convenience stores, and online retailers expanding their selection of RTD cocktail options. This wider distribution network ensures that canned cocktails are readily available to a broader audience of consumers, driving market growth and increasing consumer awareness and adoption of canned cocktail products.

Government regulations and labeling requirements also influence the US canned cocktails market. Regulatory bodies such as the Alcohol and Tobacco Tax and Trade Bureau (TTB) set guidelines for labeling, packaging, and advertising of alcoholic beverages to ensure consumer protection and transparency. Compliance with these regulations is essential for canned cocktail manufacturers to maintain product quality, safety, and consumer trust. Additionally, adherence to certifications such as Kosher or Organic may help differentiate canned cocktail products and appeal to specific consumer segments.

Competitive dynamics and market trends drive innovation and product differentiation in the US canned cocktails market. With an increasing number of players entering the market, competition is intensifying, leading to a greater variety of flavor options, cocktail recipes, and packaging formats. Companies differentiate themselves by offering unique flavor combinations, premium spirits, and innovative packaging designs that stand out on store shelves and appeal to discerning consumers. Moreover, innovation in low-calorie or low-sugar options, as well as functional enhancements such as added vitamins or botanical extracts, further contributes to product diversification and market competitiveness.

Consumer behavior and preferences continue to evolve, shaping the dynamics of the US canned cocktails market. While some consumers prioritize convenience and portability, others prioritize taste, quality, and brand reputation in their canned cocktail purchases. Understanding these preferences and market trends is essential for canned cocktail manufacturers and retailers to develop targeted marketing strategies, product offerings, and distribution channels that resonate with their target audience. Consumer education initiatives highlighting the convenience, versatility, and premium quality of canned cocktails help increase awareness and drive demand in the US market.

Leave a Comment