Market Analysis

In-depth Analysis of US Canned Cocktails (RTD Cocktails) Market Industry Landscape

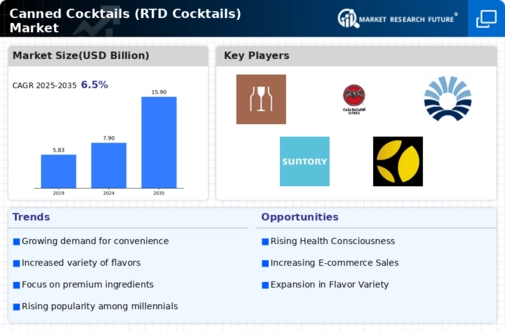

The market dynamics of the US canned cocktails, also known as Ready-to-Drink (RTD) cocktails, are shaped by several factors that influence their growth, trends, and competition. Canned cocktails have experienced a surge in popularity in recent years due to changing consumer preferences and lifestyle trends. One of the primary drivers of this market is the increasing demand for convenience and portability among consumers. Canned cocktails offer a convenient and hassle-free way to enjoy mixed drinks without the need for bartending skills or the hassle of purchasing multiple ingredients. This convenience factor makes canned cocktails particularly popular for outdoor activities, picnics, parties, and other social occasions where traditional cocktails may be impractical or inconvenient to prepare.

Moreover, the rise of the millennial and Gen Z demographics has contributed to the growing popularity of canned cocktails. Younger consumers are drawn to the convenience and novelty of canned cocktails, as well as their Instagram-worthy packaging and creative flavor profiles. Canned cocktails appeal to the modern consumer's desire for experiential and shareable products that fit their on-the-go lifestyles and social media-driven culture.

Furthermore, the COVID-19 pandemic has accelerated the growth of the canned cocktails market, as consumers have increasingly turned to packaged beverages for at-home consumption. With bars and restaurants closed or operating at limited capacity during lockdowns, many consumers have sought out convenient alternatives to traditional cocktails for enjoying at home. Canned cocktails offer a convenient and cost-effective solution for consumers looking to recreate the bar experience in the comfort of their own homes, driving sales and market growth.

In addition to changing consumer preferences, market dynamics in the US canned cocktails market are influenced by factors such as product innovation, marketing strategies, and distribution channels. Manufacturers are constantly introducing new flavors, ingredients, and packaging formats to cater to diverse consumer tastes and preferences. Marketing efforts, including social media campaigns, influencer partnerships, and in-store promotions, play a crucial role in raising awareness and driving demand for canned cocktails.

Moreover, the expanding distribution network has facilitated greater accessibility to canned cocktails for consumers across various retail channels, including supermarkets, convenience stores, liquor stores, and online platforms. The availability of canned cocktails in mainstream retail outlets has made it easier for consumers to purchase and enjoy them on a regular basis, further driving market growth.

Additionally, market dynamics are influenced by regulatory considerations, quality standards, and supply chain logistics. Manufacturers must comply with alcohol regulations and labeling requirements to ensure the quality and safety of their canned cocktails. Quality standards and certifications, such as organic and gluten-free certifications, can also impact consumer purchasing decisions and brand perception in the canned cocktails market. Efficient supply chain management, including sourcing of ingredients, production processes, and distribution logistics, is essential for meeting consumer demand and maintaining product freshness and quality.

Leave a Comment