Rising Security Concerns

The biometric authentication-identification market is experiencing growth driven by escalating security concerns across various sectors. Organizations are increasingly aware of the vulnerabilities associated with traditional authentication methods, such as passwords and PINs. In 2025, it is estimated that cybercrime will cost businesses over $10 trillion annually, prompting a shift towards more secure solutions. Biometric systems, which utilize unique physical characteristics, offer enhanced security and are less susceptible to breaches. This trend is particularly evident in sectors like banking and healthcare, where sensitive data protection is paramount. As a result, the demand for biometric solutions is likely to rise, positioning the biometric authentication-identification market as a critical component in the fight against cyber threats.

Technological Advancements

Technological advancements are significantly influencing the biometric authentication-identification market. Innovations in artificial intelligence (AI) and machine learning are enhancing the accuracy and efficiency of biometric systems. For instance, facial recognition technology has improved, achieving accuracy rates exceeding 99% in controlled environments. Furthermore, the integration of AI allows for real-time data processing, making biometric systems more responsive and user-friendly. The market is projected to reach $50 billion by 2027, driven by these technological improvements. As organizations seek to leverage cutting-edge technology to streamline operations and enhance security, the biometric authentication-identification market is poised for substantial growth.

Growing Demand in E-commerce

The rise of e-commerce is driving the biometric authentication-identification market as businesses seek to enhance security and streamline user experiences. With online retail sales projected to surpass $1 trillion in the US by 2025, the need for secure payment methods is critical. Biometric authentication offers a solution by reducing fraud and ensuring that transactions are conducted by authorized users. Retailers are increasingly adopting biometric systems to protect customer data and build trust. This trend is expected to contribute to a robust growth trajectory for the biometric authentication-identification market, as more businesses recognize the value of integrating biometric solutions into their e-commerce platforms.

Increased Mobile Device Usage

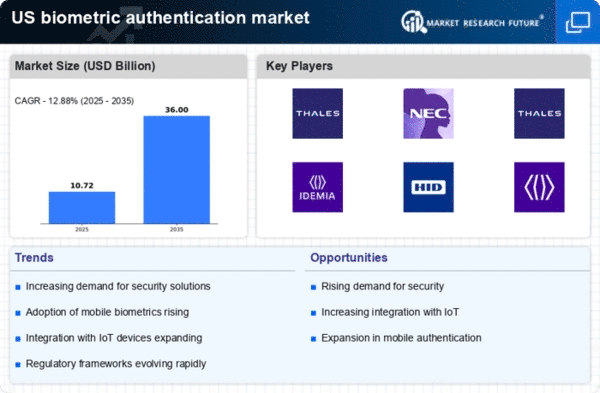

The proliferation of mobile devices is a key driver for the biometric authentication-identification market. With over 80% of the US population owning smartphones, the demand for secure mobile authentication methods has surged. Biometric features, such as fingerprint and facial recognition, are now standard in many devices, facilitating seamless user experiences while enhancing security. In 2025, it is anticipated that mobile biometric authentication will account for approximately 30% of the overall market. This trend reflects a broader shift towards mobile-first strategies, where convenience and security are paramount. As consumers increasingly rely on mobile devices for transactions and personal data management, the biometric authentication-identification market is likely to expand significantly.

Regulatory Compliance Requirements

Regulatory compliance is a significant driver for the biometric authentication-identification market. As data protection laws become more stringent, organizations are compelled to adopt secure authentication methods to comply with regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). These regulations mandate the protection of personal data, pushing businesses to implement biometric solutions that offer enhanced security. In 2025, it is estimated that compliance-related investments will exceed $20 billion in the US, with a substantial portion directed towards biometric technologies. This regulatory landscape is likely to propel the biometric authentication-identification market forward, as organizations prioritize compliance and data security.