Shift Towards Value-Based Care

The transition from fee-for-service to value-based care models is reshaping the landscape of the behavioral health-software market. This shift emphasizes the quality of care over the quantity of services provided, prompting healthcare providers to adopt software solutions that can track patient outcomes and improve care coordination. As healthcare systems increasingly focus on delivering value, behavioral health-software market solutions that offer analytics and reporting capabilities are becoming essential. This trend is likely to drive demand for software that can demonstrate efficacy and improve patient satisfaction, potentially leading to a more competitive market environment. Analysts suggest that this could result in a 15% increase in software adoption rates among healthcare providers over the next few years.

Government Initiatives and Funding

Government initiatives play a crucial role in shaping the behavioral health-software market. Various federal and state programs are increasingly allocating funds to improve mental health services and promote the use of technology in treatment. For instance, the Substance Abuse and Mental Health Services Administration (SAMHSA) has been instrumental in providing grants to support the integration of technology in behavioral health care. This financial backing not only encourages the development of innovative software solutions but also enhances accessibility for underserved populations. The behavioral health-software market stands to benefit significantly from these initiatives, as they create a conducive environment for growth and innovation, potentially increasing market size by millions of dollars in the coming years.

Technological Advancements in Treatment

Technological advancements are significantly influencing the behavioral health-software market, as new tools and methodologies emerge to enhance treatment efficacy. Innovations such as mobile health applications, virtual reality therapy, and machine learning algorithms are being integrated into software solutions, providing clinicians with advanced tools to deliver personalized care. These advancements not only improve patient engagement but also facilitate remote monitoring and real-time feedback, which are crucial for effective treatment. The behavioral health-software market is likely to see a rise in the adoption of these technologies, as they offer scalable solutions that can be tailored to individual patient needs. This trend may lead to a substantial increase in market growth, with estimates suggesting a potential market value exceeding $5 billion by 2027.

Rising Demand for Mental Health Services

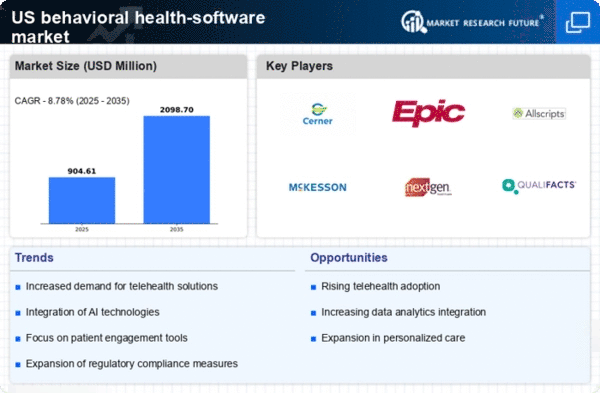

The behavioral health-software market experiences a notable surge in demand for mental health services, driven by an increasing awareness of mental health issues among the population. Recent data indicates that approximately 1 in 5 adults in the US experience mental illness each year, highlighting the urgent need for effective treatment solutions. This growing recognition of mental health's importance has led to a greater acceptance of seeking help, thereby propelling the demand for software solutions that facilitate access to care. Behavioral health-software market providers are responding by developing innovative platforms that enhance patient engagement and streamline treatment processes. As a result, the market is likely to expand, with projections suggesting a compound annual growth rate (CAGR) of around 20% over the next few years.

Increased Focus on Patient-Centric Solutions

The behavioral health-software market is witnessing a paradigm shift towards patient-centric solutions, reflecting a broader trend in healthcare. This approach prioritizes the needs and preferences of patients, encouraging software developers to create tools that enhance user experience and engagement. Features such as user-friendly interfaces, personalized treatment plans, and integrated communication channels are becoming standard in behavioral health software. This focus on patient-centricity is likely to drive higher adoption rates, as patients increasingly seek solutions that empower them in their treatment journey. Furthermore, the behavioral health-software market may experience a boost in growth as providers recognize the importance of patient satisfaction in achieving positive health outcomes, potentially leading to a 10% increase in market penetration over the next few years.