Rising Demand for Mental Health Services

The Behavioral Health Software Market Industry is experiencing a notable increase in demand for mental health services. This surge is attributed to a growing awareness of mental health issues and the importance of seeking treatment. According to recent statistics, nearly one in five adults in the United States experiences mental illness each year, which translates to approximately 51.5 million individuals. This rising prevalence of mental health conditions necessitates the development and implementation of effective behavioral health software solutions. As healthcare providers strive to meet this demand, the Behavioral Health Software Market Industry is likely to expand, offering innovative tools that enhance patient care and streamline treatment processes.

Regulatory Support and Funding Initiatives

The Behavioral Health Software Market Industry benefits from increasing regulatory support and funding initiatives aimed at improving mental health services. Governments and health organizations are recognizing the critical need for accessible mental health care, leading to the allocation of resources for software development and implementation. For instance, various federal and state programs are providing financial incentives for healthcare providers to adopt behavioral health software solutions. This support not only encourages the growth of the market but also fosters innovation in software design, ensuring that solutions are tailored to meet the specific needs of mental health professionals and their patients.

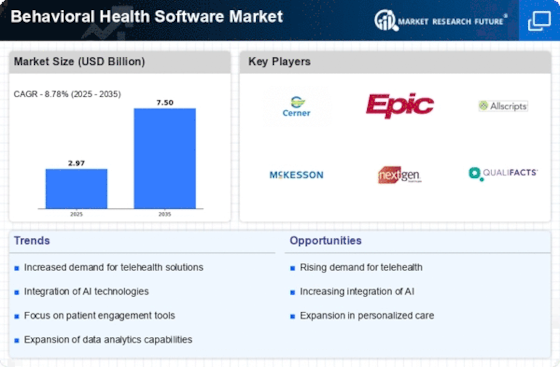

Technological Advancements in Software Solutions

Technological advancements are playing a pivotal role in shaping the Behavioral Health Software Market Industry. Innovations such as cloud computing, mobile applications, and data analytics are enhancing the functionality and accessibility of behavioral health software. These technologies enable providers to offer more personalized care, improve patient engagement, and streamline administrative processes. For example, cloud-based solutions allow for real-time data sharing and collaboration among healthcare teams, which is essential for effective treatment planning. As these technologies continue to evolve, the Behavioral Health Software Market Industry is expected to expand, driven by the demand for more sophisticated and user-friendly software solutions.

Integration of Behavioral Health and Primary Care

The integration of behavioral health and primary care is a significant driver for the Behavioral Health Software Market Industry. This trend reflects a holistic approach to healthcare, where mental health is treated alongside physical health. Research indicates that integrated care models can lead to improved patient outcomes and reduced healthcare costs. As healthcare systems increasingly adopt this model, the demand for software that facilitates communication and coordination between behavioral health and primary care providers is likely to rise. Consequently, the Behavioral Health Software Market Industry is poised for growth as it develops solutions that support this integrated care paradigm.

Increased Focus on Patient Engagement and Outcomes

The Behavioral Health Software Market Industry is witnessing an increased focus on patient engagement and outcomes. Healthcare providers are recognizing the importance of involving patients in their treatment plans, which can lead to better adherence and improved health outcomes. Software solutions that facilitate patient engagement, such as mobile apps and online portals, are becoming essential tools for providers. These platforms allow patients to access their health information, communicate with their providers, and participate in their care actively. As the emphasis on patient-centered care grows, the Behavioral Health Software Market Industry is likely to see a surge in demand for software that enhances patient engagement and tracks treatment outcomes.