Health and Wellness Trends

The increasing focus on health and wellness among consumers is reshaping the US Bakery Enzymes Market. As individuals become more health-conscious, there is a growing demand for bakery products that are not only delicious but also nutritious. Enzymes are utilized to improve the nutritional profile of baked goods, such as enhancing fiber content or reducing sugar levels. The market for healthier bakery options is expected to expand, with a projected growth rate of around 5% annually. This shift towards health-oriented products presents a lucrative opportunity for enzyme suppliers to develop innovative solutions that align with consumer preferences, thereby driving growth in the US Bakery Enzymes Market.

Growing Demand for Convenience Foods

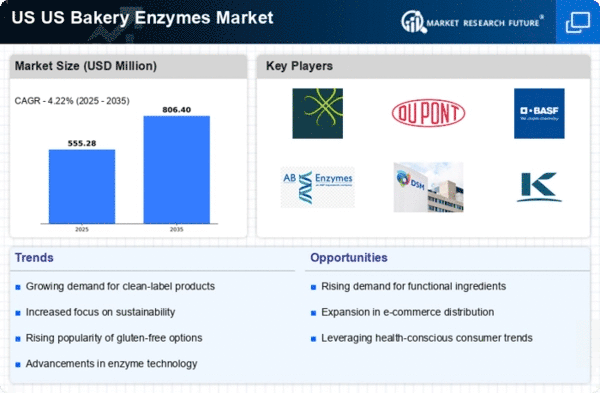

The US Bakery Enzymes Market is experiencing a notable surge in demand for convenience foods, driven by the fast-paced lifestyle of consumers. As more individuals seek quick meal solutions, the bakery sector is adapting by producing ready-to-eat and easy-to-prepare products. Enzymes play a crucial role in enhancing the texture, flavor, and shelf-life of these convenience items. According to industry reports, the convenience food segment is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% through 2026. This trend indicates a significant opportunity for enzyme manufacturers to innovate and cater to the evolving preferences of consumers, thereby solidifying their position in the US Bakery Enzymes Market.

Technological Advancements in Baking

Technological advancements in baking processes are significantly influencing the US Bakery Enzymes Market. Innovations in enzyme formulations and application techniques are enabling bakers to achieve superior product quality and consistency. For instance, the introduction of new enzyme blends allows for better dough handling and fermentation processes, resulting in improved texture and flavor. The market is witnessing a trend towards automation and precision in baking, which is likely to enhance the efficiency of enzyme usage. As bakers increasingly adopt these technologies, the demand for specialized enzymes is expected to rise, potentially leading to a market growth rate of 6% over the next few years in the US Bakery Enzymes Market.

Expansion of E-commerce in Food Sector

The expansion of e-commerce in the food sector is reshaping the landscape of the US Bakery Enzymes Market. With the rise of online grocery shopping, consumers are increasingly purchasing bakery products through digital platforms. This trend necessitates the need for longer shelf-life and better preservation of baked goods, which enzymes can effectively provide. The e-commerce food market is projected to grow at a CAGR of 7% through 2026, indicating a substantial opportunity for enzyme suppliers to cater to this evolving distribution channel. As online sales of bakery products increase, the demand for innovative enzyme solutions that enhance product quality and longevity is likely to rise, further driving growth in the US Bakery Enzymes Market.

Sustainability and Environmental Concerns

Sustainability is becoming a pivotal concern within the US Bakery Enzymes Market. Consumers are increasingly favoring products that are environmentally friendly and produced through sustainable practices. Enzymes can contribute to sustainability by reducing waste and energy consumption during the baking process. For example, the use of enzymes can enhance the efficiency of ingredient utilization, leading to less waste. The market is likely to see a rise in demand for enzymes that support sustainable baking practices, with projections indicating a growth rate of approximately 4% in this segment. This shift towards sustainability presents an opportunity for enzyme manufacturers to align their products with consumer values, thereby enhancing their market presence in the US Bakery Enzymes Market.