Growth of the Automotive Industry

The automotive pressure-sensor market is poised for growth, driven by the overall expansion of the automotive industry in the United States. With vehicle production expected to increase, the demand for pressure sensors is likely to rise correspondingly. In 2025, the automotive industry is projected to generate revenues exceeding $800 billion, creating a favorable environment for the automotive pressure-sensor market. This growth is further fueled by the introduction of new vehicle models that incorporate advanced technologies, necessitating the integration of high-performance pressure sensors. As manufacturers seek to enhance vehicle efficiency and performance, the automotive pressure-sensor market stands to gain significantly from this upward trend.

Increased Focus on Fuel Efficiency

The automotive pressure-sensor market is significantly influenced by the heightened focus on fuel efficiency among consumers and manufacturers alike. As fuel prices fluctuate, there is a growing demand for technologies that enhance vehicle performance and reduce emissions. Pressure sensors play a crucial role in optimizing engine performance and fuel consumption, making them indispensable in modern vehicles. The automotive industry is increasingly adopting pressure sensors to monitor and control various systems, thereby improving fuel efficiency by up to 15%. This trend not only aligns with consumer preferences but also supports regulatory compliance, further driving the growth of the automotive pressure-sensor market.

Rising Demand for Advanced Safety Features

The automotive pressure-sensor market experiences a notable surge in demand due to the increasing emphasis on advanced safety features in vehicles. As consumers become more safety-conscious, manufacturers are integrating sophisticated pressure sensors to monitor tire pressure, brake systems, and engine performance. This trend is reflected in the growing adoption of systems such as Tire Pressure Monitoring Systems (TPMS), which have become mandatory in many vehicles. The market for TPMS alone is projected to reach approximately $3 billion by 2026. Consequently, the automotive pressure-sensor market is likely to benefit from this heightened focus on safety, as automakers strive to meet consumer expectations and regulatory requirements.

Shift Towards Electric and Hybrid Vehicles

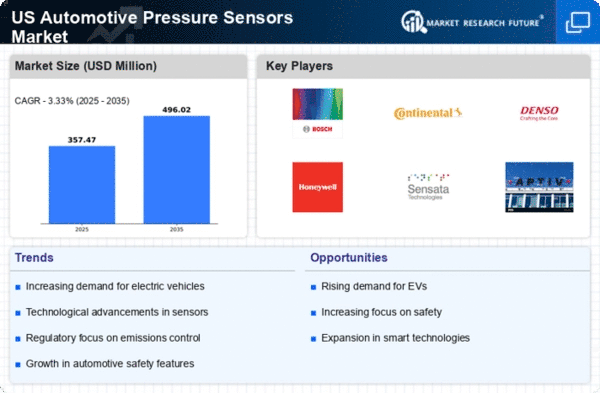

The automotive pressure-sensor market is adapting to the shift to electric and hybrid vehicles, which require specialized pressure monitoring systems. As the market for electric vehicles (EVs) expands, the need for pressure sensors in battery management systems and cooling systems becomes increasingly critical. In 2025, the EV market is projected to account for over 25% of total vehicle sales in the United States, creating substantial opportunities for the automotive pressure-sensor market. This transition not only necessitates the integration of advanced pressure sensors but also encourages innovation in sensor technology to meet the unique demands of electric and hybrid vehicles. Consequently, the automotive pressure-sensor market is likely to experience growth driven by this evolving landscape.

Technological Innovations in Sensor Design

The automotive pressure-sensor market is witnessing a wave of technological innovations that enhance sensor design and functionality. Advances in materials science and microelectronics have led to the development of more compact, accurate, and reliable pressure sensors. These innovations enable sensors to operate effectively in extreme conditions, which is essential for modern automotive applications. For instance, the introduction of MEMS (Micro-Electro-Mechanical Systems) technology has revolutionized sensor capabilities, allowing for greater precision and responsiveness. As manufacturers continue to invest in research and development, the automotive pressure-sensor market is likely to benefit from these advancements, leading to improved product offerings and increased market penetration.