Expansion of Smart City Initiatives

The expansion of smart city initiatives across the US is playing a pivotal role in shaping the automotive lidar-sensors market. As urban areas increasingly adopt smart technologies to improve traffic management and reduce congestion, the demand for advanced sensor systems like lidar is expected to rise. These systems facilitate real-time data collection and analysis, which are essential for the effective functioning of smart transportation networks. By 2025, it is projected that investments in smart city projects will exceed $100 billion, creating a substantial market opportunity for lidar manufacturers. This trend suggests that the automotive lidar-sensors market will benefit from increased collaboration between city planners and technology providers, leading to innovative applications of lidar technology in urban environments.

Growth in Fleet Management Solutions

The automotive lidar-sensors market is also being driven by the growth of fleet management solutions that leverage advanced sensor technologies. Companies are increasingly adopting lidar-equipped vehicles to enhance operational efficiency and safety within their fleets. The integration of lidar sensors allows for improved navigation, obstacle detection, and route optimization, which are critical for fleet operators. As of 2025, the market for fleet management solutions is expected to grow by approximately 20%, further boosting the demand for automotive lidar-sensors. This growth indicates a shift towards more automated and intelligent fleet operations, where lidar technology plays a crucial role in ensuring safety and efficiency. Consequently, the automotive lidar-sensors market is likely to see increased investment and innovation as fleet operators seek to enhance their capabilities.

Regulatory Support for Autonomous Vehicles

Regulatory frameworks in the US are increasingly supportive of autonomous vehicle technologies, which significantly impacts the automotive lidar-sensors market. Government initiatives aimed at promoting the safe deployment of self-driving cars are creating a favorable environment for lidar adoption. For instance, the National Highway Traffic Safety Administration (NHTSA) has established guidelines that encourage the integration of advanced sensor technologies in vehicles. This regulatory support is expected to enhance consumer confidence and stimulate market growth. By 2025, it is anticipated that the automotive lidar-sensors market will benefit from these regulations, potentially increasing its market share by up to 15%. As a result, manufacturers are likely to align their product offerings with regulatory standards, further driving innovation in the sector.

Rising Demand for Enhanced Safety Features

The automotive lidar-sensors market is significantly influenced by the rising demand for enhanced safety features in vehicles. Consumers are increasingly prioritizing safety, leading automakers to integrate advanced driver-assistance systems (ADAS) that utilize lidar technology. According to recent data, vehicles equipped with lidar sensors can reduce accident rates by up to 40%, making them an attractive option for safety-conscious buyers. This trend is expected to continue, with the market projected to grow as more manufacturers incorporate lidar into their safety systems. By 2025, the automotive lidar-sensors market could see an increase in sales volume, driven by consumer preferences for vehicles that offer superior safety features. Consequently, this demand is likely to encourage further investment in lidar technology, fostering innovation and competition among manufacturers.

Technological Advancements in Lidar Systems

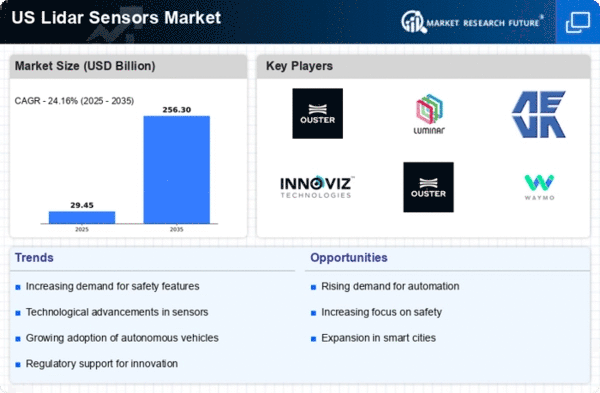

The automotive lidar-sensors market is experiencing a surge due to rapid technological advancements in lidar systems. Innovations such as solid-state lidar and enhanced sensor resolution are driving the market forward. These advancements improve the accuracy and reliability of autonomous vehicles, which is crucial for safety and efficiency. As of 2025, the market is projected to reach approximately $3 billion, reflecting a compound annual growth rate (CAGR) of around 25% over the next five years. This growth is largely attributed to the increasing demand for high-performance sensors that can operate in diverse environmental conditions. Consequently, manufacturers are investing heavily in research and development to create more sophisticated lidar solutions, thereby propelling the automotive lidar-sensors market to new heights.