Market Trends

Key Emerging Trends in the US Automotive Industry Market

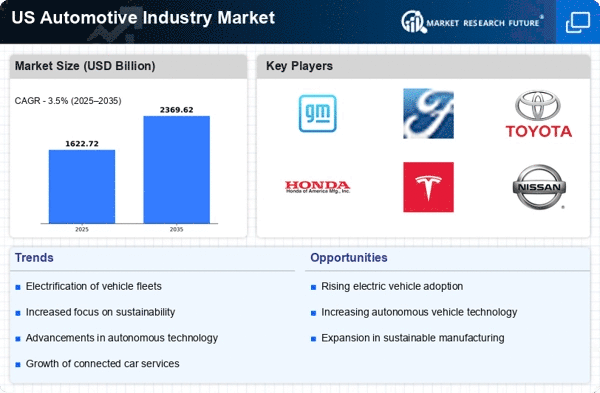

The automotive industry in the United States is constantly evolving, shaped by various market trends that influence consumer behavior, technological advancements, and regulatory changes. One prominent trend in recent years is the growing demand for electric vehicles (EVs) and hybrid cars. With increasing awareness of environmental issues and the push for sustainability, consumers are showing more interest in vehicles that offer lower emissions and better fuel efficiency. As a result, major automakers are investing heavily in the development of EV technology, with many introducing new electric models to cater to this expanding market segment.

Another significant trend in the US automotive industry is the rise of autonomous vehicles (AVs) and advanced driver-assistance systems (ADAS). As technology continues to advance, the prospect of self-driving cars becomes more feasible, promising enhanced safety, convenience, and efficiency on the roads. Companies like Tesla, Google's Waymo, and traditional automakers are actively pursuing AV technology, conducting extensive research and development to bring autonomous vehicles to market. Additionally, the integration of ADAS features, such as adaptive cruise control and lane-keeping assistance, is becoming increasingly common in modern vehicles, paving the way for fully autonomous driving in the future.

Furthermore, there is a growing shift towards shared mobility and transportation-as-a-service (TaaS) models in the US automotive market. Ride-hailing services like Uber and Lyft have transformed urban transportation, offering convenient alternatives to traditional car ownership. This trend is expected to continue as advancements in technology and changes in consumer behavior drive the adoption of shared mobility solutions. Additionally, the emergence of electric and autonomous vehicles in ride-hailing fleets could further disrupt the automotive industry, potentially reshaping urban mobility patterns and reducing the overall demand for private vehicle ownership.

In terms of market dynamics, the US automotive industry is also experiencing a shift in consumer preferences towards SUVs, trucks, and crossover vehicles. These larger, more versatile vehicles have become increasingly popular among American consumers, outselling traditional sedans in recent years. Automakers have responded to this trend by expanding their SUV and truck lineups, introducing new models and variants to meet the growing demand for larger vehicles. This shift towards SUVs and trucks has significant implications for manufacturers, influencing product development strategies and production planning.

Moreover, the COVID-19 pandemic has had a profound impact on the US automotive industry, causing disruptions in production, supply chains, and consumer demand. The temporary closure of manufacturing facilities and dealership shutdowns resulted in a sharp decline in vehicle sales during the initial stages of the pandemic. However, the industry has shown resilience, adapting to new challenges and implementing safety protocols to ensure business continuity. As the economy gradually recovers and vaccination efforts progress, the automotive market is expected to rebound, albeit with some lingering effects and shifts in consumer behavior.

In conclusion, the US automotive industry is characterized by several key market trends that are shaping its trajectory in the coming years. From the growing demand for electric and autonomous vehicles to the rise of shared mobility and SUVs, these trends reflect changing consumer preferences, technological advancements, and external factors such as the COVID-19 pandemic. As automakers navigate these challenges and opportunities, innovation, adaptability, and strategic decision-making will be crucial in staying competitive and meeting the evolving needs of consumers in the dynamic automotive market.

Leave a Comment