Rising Fuel Efficiency Standards

The automotive fuel-tank market is experiencing a notable impact from the increasing fuel efficiency standards mandated by regulatory bodies in the US. These standards, which aim to reduce greenhouse gas emissions and enhance fuel economy, compel manufacturers to innovate and optimize fuel-tank designs. As a result, the market is witnessing a shift towards advanced materials and engineering techniques that allow for lighter and more efficient fuel tanks. According to recent data, the average fuel economy of new vehicles is projected to reach 54.5 mpg by 2025, necessitating the development of fuel tanks that can accommodate these advancements while maintaining safety and performance. This regulatory environment is likely to drive growth in the automotive fuel-tank market as manufacturers adapt to meet these stringent requirements.

Growing Demand for Electric Vehicles

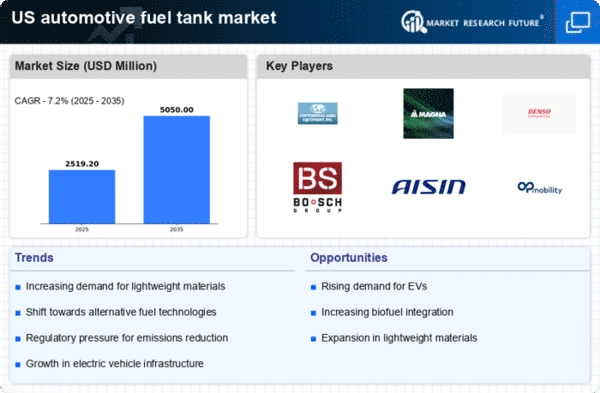

The automotive fuel-tank market is being influenced by the growing demand for electric vehicles (EVs) in the US. As consumers increasingly shift towards EVs, traditional fuel-tank manufacturers are compelled to diversify their product offerings. While EVs do not require conventional fuel tanks, the transition presents opportunities for manufacturers to innovate in areas such as hydrogen fuel tanks and battery storage solutions. The US EV market is projected to grow at a CAGR of 20% through 2025, indicating a potential shift in focus for fuel-tank manufacturers. This evolving landscape may lead to collaborations between traditional automotive fuel-tank producers and new entrants in the EV sector, ultimately reshaping the automotive fuel-tank market.

Increased Focus on Safety Regulations

Safety regulations are becoming increasingly stringent in the automotive fuel-tank market, driving manufacturers to prioritize safety features in their designs. Regulatory bodies in the US are implementing more rigorous testing and certification processes for fuel tanks, particularly concerning crash safety and leak prevention. This heightened focus on safety is prompting manufacturers to invest in research and development to create fuel tanks that not only meet but exceed these regulations. For example, the National Highway Traffic Safety Administration (NHTSA) has introduced new standards that require enhanced crashworthiness for fuel tanks, which could lead to a 15% increase in production costs. Consequently, the automotive fuel-tank market is likely to see a shift towards more robust and safer fuel-tank designs.

Sustainability Initiatives in Manufacturing

Sustainability initiatives are increasingly shaping the automotive fuel-tank market as manufacturers seek to reduce their environmental footprint. The push for eco-friendly production methods and materials is gaining traction, with many companies adopting practices that minimize waste and energy consumption. For instance, the use of recycled materials in fuel-tank production is becoming more prevalent, aligning with consumer preferences for sustainable products. Recent studies indicate that incorporating recycled materials can reduce production costs by up to 30%, making it an attractive option for manufacturers. As sustainability becomes a core value for consumers and regulatory bodies alike, the automotive fuel-tank market is likely to evolve, with a greater emphasis on environmentally responsible manufacturing practices.

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes are significantly influencing the automotive fuel-tank market. Innovations such as 3D printing, automated assembly lines, and advanced welding techniques are enhancing production efficiency and reducing costs. These technologies enable manufacturers to produce complex fuel-tank designs with greater precision and less waste. For instance, the adoption of 3D printing has been shown to reduce production time by up to 50%, allowing for quicker market entry of new products. Furthermore, these advancements facilitate the integration of features such as improved safety mechanisms and enhanced fuel storage capabilities. As manufacturers continue to invest in these technologies, the automotive fuel-tank market is expected to expand, driven by the demand for more sophisticated and efficient fuel-tank solutions.