Rising Environmental Concerns

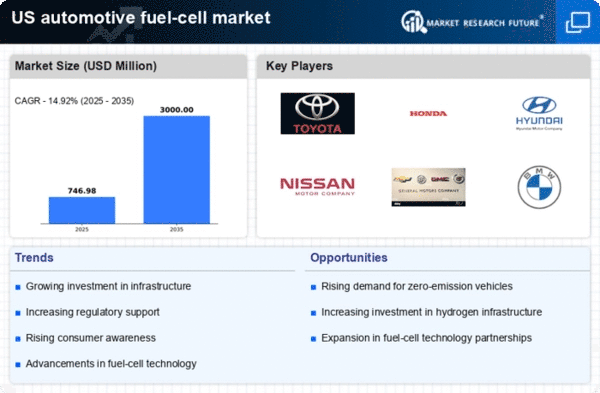

The automotive fuel-cell market is experiencing a surge in interest due to increasing environmental concerns among consumers and policymakers. As awareness of climate change and air pollution grows, there is a notable shift towards cleaner transportation solutions. Fuel cells, which emit only water vapor, are seen as a viable alternative to traditional internal combustion engines. In the US, the transportation sector accounts for approximately 29% of greenhouse gas emissions, prompting a push for zero-emission vehicles. This trend is likely to drive investments in fuel-cell technology, as manufacturers seek to align with sustainability goals and meet regulatory requirements. The automotive fuel-cell market is thus positioned to benefit from this heightened focus on environmental stewardship, potentially leading to increased adoption rates and market growth.

Supportive Regulatory Frameworks

The automotive fuel-cell market is benefiting from a supportive regulatory environment in the US. Federal and state governments are implementing policies aimed at promoting clean energy technologies, including fuel cells. Incentives such as tax credits, grants, and subsidies are being offered to manufacturers and consumers to encourage the adoption of fuel-cell vehicles. For example, the US Department of Energy has set ambitious targets for hydrogen production and fuel-cell deployment, aiming for a significant increase in the number of fuel-cell vehicles on the road by 2030. This regulatory support is likely to enhance the attractiveness of the automotive fuel-cell market, fostering innovation and investment in the sector.

Advancements in Fuel-Cell Technology

Technological innovations are playing a crucial role in shaping the automotive fuel-cell market. Recent advancements in fuel-cell efficiency, durability, and cost reduction are making these systems more attractive to manufacturers and consumers alike. For instance, improvements in membrane technology and catalyst materials have enhanced performance while reducing production costs. The average cost of fuel-cell systems has decreased significantly, with estimates suggesting a reduction of over 50% in the last decade. This trend is likely to continue as research and development efforts intensify. As a result, the automotive fuel-cell market may witness a broader range of applications and increased competitiveness against battery electric vehicles, further stimulating market growth.

Collaboration Between Industry Players

Collaboration among various stakeholders is becoming increasingly important in the automotive fuel-cell market. Partnerships between automotive manufacturers, technology firms, and energy providers are fostering innovation and accelerating the development of fuel-cell technologies. These collaborations often focus on research and development, sharing resources, and pooling expertise to overcome technical challenges. For instance, joint ventures are being formed to create integrated solutions that combine fuel-cell technology with renewable energy sources. Such collaborative efforts are likely to enhance the competitiveness of the automotive fuel-cell market, driving advancements that could lead to greater market penetration and consumer acceptance.

Growing Investment in Hydrogen Infrastructure

Investment in hydrogen infrastructure is emerging as a key driver for the automotive fuel-cell market. The establishment of refueling stations and distribution networks is essential for the widespread adoption of fuel-cell vehicles. In the US, several initiatives are underway to expand hydrogen infrastructure, with funding from both public and private sectors. Reports indicate that the number of hydrogen refueling stations is expected to increase significantly, potentially reaching over 1,000 stations by 2030. This expansion is likely to alleviate range anxiety among consumers and enhance the viability of fuel-cell vehicles, thereby stimulating demand in the automotive fuel-cell market.