Increased Focus on Sustainability

The automotive display market is witnessing a growing emphasis on sustainability, driven by consumer awareness and regulatory pressures. In 2025, it is projected that sustainable materials and energy-efficient display technologies will become a priority for manufacturers. This shift is not only about reducing environmental impact but also about meeting consumer expectations for eco-friendly products. Displays that utilize recyclable materials and consume less power are likely to gain traction in the market. Furthermore, as automakers strive to enhance their sustainability profiles, the automotive display market may see increased investment in research and development of green technologies. This focus on sustainability could potentially reshape the competitive landscape, as companies that prioritize eco-friendly practices may gain a competitive edge.

Rising Demand for Electric Vehicles

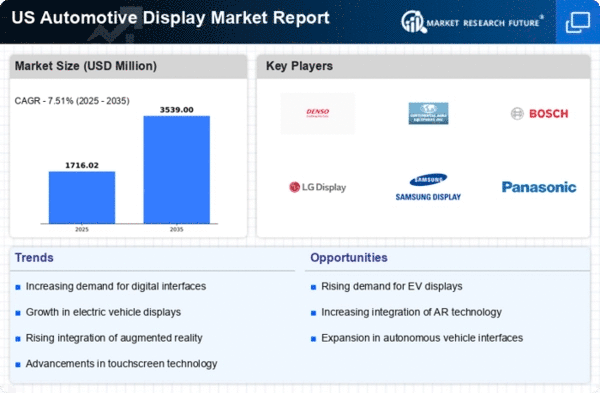

The automotive display market is experiencing a notable surge in demand due to the increasing adoption of electric vehicles (EVs) in the US. As consumers gravitate towards EVs, manufacturers are integrating advanced display technologies to enhance user experience and vehicle functionality. In 2025, it is projected that EV sales will account for approximately 25% of total vehicle sales in the US, driving the need for sophisticated displays that provide real-time data on battery status, navigation, and energy consumption. This shift towards electrification necessitates innovative display solutions, thereby propelling growth in the automotive display market. Furthermore, the integration of displays in EVs is not merely for aesthetics; it serves critical functions that improve safety and efficiency, indicating a robust future for the automotive display market.

Regulatory Compliance and Safety Standards

The automotive display market is also being shaped by stringent regulatory compliance and safety standards in the US. As vehicle technology evolves, regulatory bodies are implementing guidelines to ensure that display systems do not distract drivers while providing essential information. In 2025, it is anticipated that compliance with these regulations will drive innovation in display design, focusing on user-friendly interfaces that prioritize safety. Manufacturers are increasingly investing in research and development to create displays that meet these standards, which may include features such as adaptive brightness and voice control. This focus on safety not only enhances the driving experience but also positions the automotive display market for sustainable growth as regulations become more rigorous.

Consumer Preference for Connectivity Features

Consumer preferences are shifting towards vehicles equipped with advanced connectivity features, which is significantly impacting the automotive display market. In 2025, it is estimated that over 60% of new vehicles sold in the US will include integrated infotainment systems that rely heavily on display technology. These systems provide seamless connectivity with smartphones and other devices, allowing for enhanced navigation, entertainment, and communication options. As consumers demand more integrated solutions, manufacturers are compelled to innovate their display offerings to include features such as touchscreens, voice recognition, and smartphone mirroring. This trend towards connectivity is likely to drive substantial growth in the automotive display market, as it aligns with the broader movement towards smart technology in vehicles.

Technological Advancements in Display Systems

Technological advancements are significantly influencing the automotive display market. Innovations such as OLED and LCD technologies are becoming increasingly prevalent, offering superior image quality and energy efficiency. In 2025, the market for OLED displays in vehicles is expected to grow by over 30%, reflecting a shift towards high-definition visual experiences. These advancements allow for more interactive and customizable interfaces, which are essential in modern vehicles. Additionally, the integration of augmented reality (AR) displays is emerging as a game-changer, providing drivers with enhanced navigation and safety features. As manufacturers strive to differentiate their offerings, the automotive display market is likely to benefit from these technological enhancements, leading to a more immersive driving experience.