Consumer Preference for Customization

Customization is becoming a key driver in the automotive smart-display market, as consumers seek personalized experiences in their vehicles. The ability to tailor display interfaces to individual preferences enhances user satisfaction and engagement. Recent surveys indicate that over 55% of consumers in the US are willing to pay extra for vehicles that offer customizable smart displays. This trend suggests that manufacturers are increasingly focusing on developing flexible display solutions that cater to diverse consumer needs, thereby stimulating growth in the automotive smart-display market.

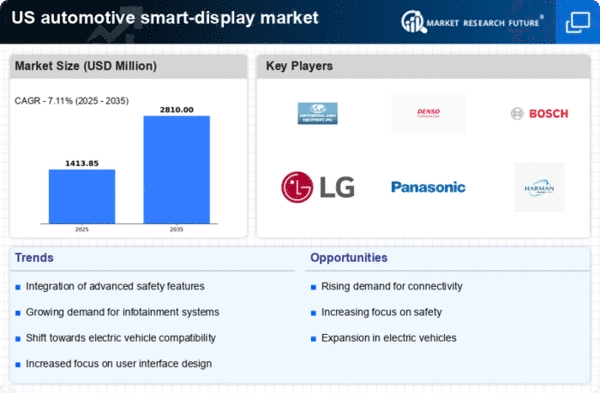

Rising Demand for Connectivity Features

The automotive smart-display market is experiencing a notable surge in demand for enhanced connectivity features. As consumers increasingly seek seamless integration of their mobile devices with in-vehicle systems, manufacturers are responding by incorporating advanced connectivity options such as Apple CarPlay and Android Auto. This trend is reflected in market data, indicating that approximately 60% of new vehicles sold in the US are equipped with some form of smart-display technology. The growing expectation for real-time information and entertainment while driving is propelling the automotive smart-display market forward, as consumers prioritize features that enhance their driving experience.

Increased Focus on Safety and Navigation

Safety remains a paramount concern for consumers, driving the automotive smart-display market towards innovations that enhance navigation and driver assistance. The integration of advanced navigation systems, including real-time traffic updates and predictive routing, is becoming standard in modern vehicles. According to recent statistics, nearly 70% of drivers in the US express a preference for vehicles equipped with smart displays that offer enhanced safety features. This focus on safety not only improves the driving experience but also aligns with regulatory trends aimed at reducing road accidents, thereby fostering growth in the automotive smart-display market.

Growth of Electric and Autonomous Vehicles

The automotive smart-display market is poised for growth due to the increasing prevalence of electric and autonomous vehicles. As these vehicles become more mainstream, the demand for sophisticated smart displays that can manage complex vehicle functions is rising. Market analysis suggests that by 2026, electric vehicles could account for over 25% of new car sales in the US, necessitating advanced display technologies that provide critical information about battery status, charging locations, and autonomous driving features. This shift towards electrification and automation is likely to drive innovation within the automotive smart-display market.

Technological Advancements in Display Quality

Technological advancements in display quality are significantly impacting the automotive smart-display market. Innovations such as OLED and high-resolution displays are enhancing visual clarity and user interaction. As consumers demand more immersive experiences, manufacturers are investing in cutting-edge display technologies that provide vibrant colors and improved responsiveness. Market data indicates that the adoption of high-definition displays in vehicles is expected to increase by 40% over the next five years. This emphasis on superior display quality is likely to drive competition and innovation within the automotive smart-display market.