Rising Vehicle Complexity

The US automotive diagnostic-tool market is experiencing growth due to the increasing complexity of modern vehicles. As vehicles incorporate advanced technologies such as electric drivetrains, autonomous systems, and sophisticated infotainment, the need for specialized diagnostic tools becomes paramount. In 2025, it is estimated that over 70% of new vehicles will feature advanced driver-assistance systems (ADAS), necessitating tools capable of diagnosing and troubleshooting these intricate systems. This complexity drives demand for diagnostic tools that can interface with multiple vehicle systems, thereby enhancing the efficiency of repairs and maintenance. Consequently, the automotive diagnostic-tool market is likely to expand as manufacturers and repair shops seek tools that can keep pace with evolving vehicle technologies.

Increased Vehicle Ownership

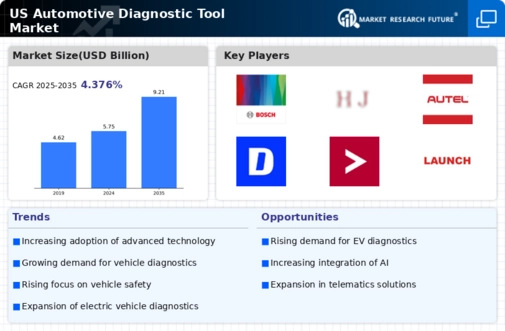

The US automotive diagnostic-tool market is benefiting from the rising vehicle ownership rates in the US. As more households acquire vehicles, the demand for maintenance and repair services escalates. In 2025, it is projected that the number of registered vehicles in the US will surpass 270 million, leading to a corresponding increase in the need for effective diagnostic tools. This surge in vehicle ownership creates a robust market for diagnostic tools, as both professional mechanics and DIY enthusiasts seek reliable solutions for vehicle maintenance. Consequently, the automotive diagnostic-tool market is likely to see a compound annual growth rate (CAGR) of approximately 10% over the next five years, driven by this growing consumer base.

Regulatory Compliance and Standards

The US automotive diagnostic-tool market is significantly influenced by regulatory compliance and standards set forth by government agencies. In the US, regulations regarding emissions and safety are becoming increasingly stringent. For instance, the Environmental Protection Agency (EPA) mandates that vehicles meet specific emissions standards, which necessitates the use of diagnostic tools for compliance testing. As a result, the market for automotive diagnostic tools is projected to grow, with an expected increase of 15% in demand for tools that can perform emissions diagnostics by 2026. This regulatory landscape compels manufacturers to innovate and develop tools that not only meet current standards but also anticipate future regulatory changes, thereby driving market growth.

Technological Integration in Repair Shops

The US automotive diagnostic-tool market is being propelled by the integration of advanced technologies in repair shops. Many service centers are adopting digital solutions that enhance operational efficiency and customer service. For instance, the use of cloud-based diagnostic tools allows for real-time data access and remote troubleshooting, which can significantly reduce repair times. By 2025, it is anticipated that over 40% of repair shops will utilize such integrated systems, thereby increasing the demand for compatible diagnostic tools. This trend indicates a shift towards more sophisticated diagnostic solutions that can seamlessly integrate with existing shop management software, further driving growth in the automotive diagnostic-tool market.

Growing Awareness of Preventive Maintenance

The US automotive diagnostic-tool market is also influenced by the growing awareness of preventive maintenance among vehicle owners. As consumers become more informed about the benefits of regular vehicle check-ups, the demand for diagnostic tools that facilitate early detection of issues is likely to rise. In 2025, surveys indicate that approximately 60% of vehicle owners prioritize preventive maintenance, leading to increased sales of diagnostic tools designed for routine checks. This trend suggests that the automotive diagnostic-tool market will expand as manufacturers respond to consumer demand for tools that promote vehicle longevity and reliability, thereby enhancing overall market dynamics.