Healthcare Infrastructure Improvements

Improvements in healthcare infrastructure across the US are significantly impacting the atherectomy devices market. Enhanced facilities and increased access to advanced medical technologies are facilitating the adoption of innovative treatment options. As hospitals and clinics upgrade their equipment and capabilities, the integration of atherectomy devices into standard practice becomes more feasible. The atherectomy devices market is poised to benefit from these infrastructural advancements, as they enable healthcare providers to offer a wider range of services. Additionally, the expansion of outpatient facilities and specialized cardiovascular centers is likely to increase the volume of atherectomy procedures performed, further driving market growth.

Technological Innovations in Device Design

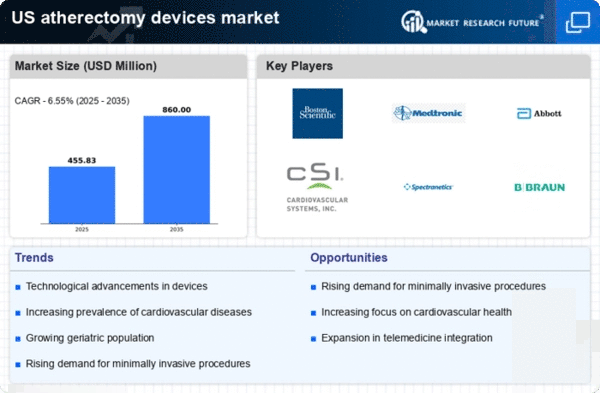

Technological innovations play a crucial role in shaping the atherectomy devices market. Continuous advancements in device design, such as the development of more efficient and user-friendly systems, are enhancing the effectiveness of atherectomy procedures. For instance, the introduction of laser and rotational atherectomy devices has improved the precision of plaque removal, leading to better patient outcomes. The atherectomy devices market is witnessing a surge in research and development activities, with companies investing heavily in innovative technologies. This focus on innovation is expected to drive market growth, as healthcare providers seek the latest solutions to improve procedural success rates and patient safety.

Aging Population and Associated Health Issues

The aging population in the US is a significant factor influencing the atherectomy devices market. As individuals age, the incidence of cardiovascular diseases tends to increase, leading to a higher demand for effective treatment options. Current statistics indicate that approximately 80% of individuals over 65 years old have at least one chronic health condition, with cardiovascular diseases being prevalent. This demographic shift is expected to drive the atherectomy devices market, as healthcare systems adapt to meet the needs of an older population. The increasing prevalence of conditions such as atherosclerosis necessitates the use of atherectomy devices, which are designed to remove plaque from arteries, thereby improving patient outcomes.

Increasing Demand for Minimally Invasive Procedures

The growing preference for minimally invasive procedures is a notable driver in the atherectomy devices market. Patients and healthcare providers alike are increasingly favoring techniques that reduce recovery time and minimize surgical risks. This trend is reflected in the rising number of procedures performed, with estimates suggesting that minimally invasive surgeries account for over 60% of all cardiovascular interventions in the US. As a result, the demand for atherectomy devices, which facilitate such procedures, is expected to rise. The atherectomy devices market is likely to benefit from this shift, as advancements in device technology continue to enhance efficacy and safety, further encouraging adoption among healthcare professionals.

Rising Awareness and Education on Cardiovascular Health

Increasing awareness and education regarding cardiovascular health are pivotal in driving the atherectomy devices market. Public health campaigns and educational initiatives have heightened understanding of cardiovascular diseases and the importance of early intervention. As awareness grows, more patients are seeking treatment options, leading to an uptick in procedures that utilize atherectomy devices. The atherectomy devices market is likely to benefit from this trend, as healthcare providers are encouraged to adopt these devices in their treatment protocols. Furthermore, the emphasis on preventive care and early diagnosis is expected to result in a higher demand for atherectomy procedures, thereby propelling market growth.