Us Antimicrobial Plastics Size

US Antimicrobial Plastics Market Growth Projections and Opportunities

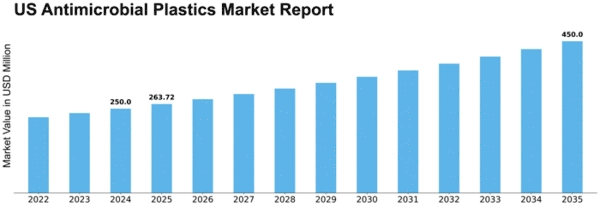

US Antimicrobial Plastics Market Size was valued at USD 7.2 Billion in 2022. The antimicrobial plastics industry is projected to grow from USD 7.79 Billion in 2023 to USD 14.634 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 8.20%

The US Antimicrobial Plastics Market is influenced by a range of market factors that collectively contribute to its growth and dynamics. A significant driver is the increasing awareness and emphasis on hygiene and infection control, especially in sectors such as healthcare, packaging, and consumer goods. Antimicrobial plastics, infused with agents that inhibit the growth of bacteria and other microorganisms, have gained prominence as a solution to address hygiene concerns. The ongoing global health challenges, including the COVID-19 pandemic, have heightened the demand for antimicrobial plastics as a means to enhance safety and minimize the risk of surface-borne infections in the United States.

Moreover, the healthcare sector's role in driving the adoption of antimicrobial plastics is crucial. Medical devices, hospital surfaces, and packaging for pharmaceuticals are key applications where antimicrobial plastics are extensively used. The need for infection prevention in healthcare settings, combined with the ongoing advancements in medical technology, has led to a growing reliance on antimicrobial plastics to create safer environments for patients and healthcare professionals in the US market.

Technological advancements and innovations in antimicrobial plastic formulations contribute to market dynamics. Continuous research and development efforts aim to improve the effectiveness, durability, and versatility of antimicrobial agents embedded in plastics. Innovations also focus on expanding the range of plastics that can be rendered antimicrobial, allowing for broader applications across various industries. These advancements drive the evolution of antimicrobial plastics in the US market, making them more adaptable to diverse consumer needs and industry requirements.

Consumer preferences for products with enhanced hygiene features influence the antimicrobial plastics market. In the wake of increased health awareness, consumers seek products that offer additional protection against microbial contamination. This has led to the incorporation of antimicrobial plastics in everyday items such as household goods, kitchenware, and personal care items. The consumer-driven demand for products that contribute to a cleaner and safer environment contributes to the widespread adoption of antimicrobial plastics in the US.

Government regulations and standards related to public health and safety impact the antimicrobial plastics market. Regulatory agencies set guidelines and standards for the use of antimicrobial agents in plastics, ensuring their safety and efficacy. Compliance with these regulations is crucial for manufacturers to guarantee the quality and performance of antimicrobial plastics in various applications. The adherence to standards helps build consumer trust and confidence in the antimicrobial products available in the US market.

Market competition and industry collaborations are notable factors shaping the US Antimicrobial Plastics Market. The presence of both established and emerging players in the industry fosters a competitive landscape. Collaboration between antimicrobial plastic manufacturers, research institutions, and end-users contributes to the development of new formulations and applications. Partnerships within the industry supply chain also drive innovation and create synergies that benefit the overall growth of the antimicrobial plastics market.

Global economic conditions and trade dynamics impact the antimicrobial plastics market. As a globally traded commodity, factors such as international trade agreements, tariffs, and geopolitical events can influence the supply chain and market conditions for antimicrobial plastics in the US. Economic stability and trade policies play a role in determining the accessibility and cost competitiveness of antimicrobial plastic materials.

Challenges related to consumer perceptions, environmental sustainability, and potential microbial resistance are factors that the antimicrobial plastics industry addresses. Educating consumers about the benefits and limitations of antimicrobial plastics, ensuring environmentally responsible manufacturing processes, and addressing concerns related to microbial resistance are ongoing challenges. The industry's ability to transparently communicate and address these challenges contributes to the sustainable growth of the antimicrobial plastics market in the United States.

Leave a Comment