Rising Air Travel Demand

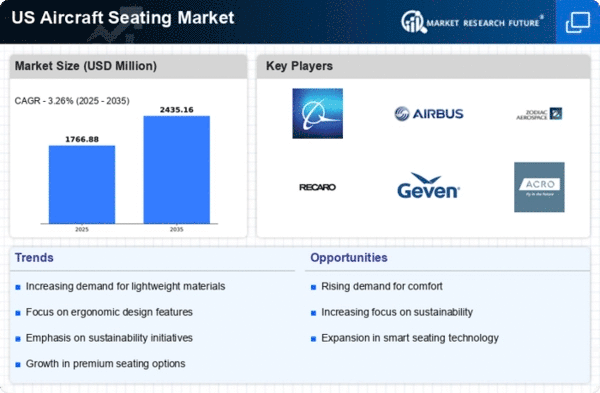

The aircraft seating market experiences a notable boost due to the increasing demand for air travel in the United States. As more individuals opt for air travel for both business and leisure, airlines are compelled to expand their fleets and enhance passenger capacity. This trend is reflected in the projected growth of the aviation sector, which anticipates a rise in passenger numbers by approximately 4.5% annually over the next decade. Consequently, airlines are investing in new aircraft and retrofitting existing ones, leading to a heightened demand for innovative seating solutions. The aircraft seating market is thus positioned to benefit from this surge, as airlines seek to optimize space and improve passenger comfort, ultimately driving revenue growth in the sector.

Focus on Passenger Comfort

In the aircraft seating market, there is an increasing emphasis on passenger comfort, which is becoming a critical differentiator for airlines. As competition intensifies, airlines are recognizing that enhanced seating can significantly influence customer satisfaction and loyalty. This trend is evidenced by the growing investment in ergonomic designs and premium seating options, which cater to the evolving preferences of travelers. According to industry reports, airlines that prioritize passenger comfort can see a 15% increase in customer retention rates. The aircraft seating market is thus adapting to these demands by innovating seating designs that provide better legroom, adjustable features, and improved materials, ensuring a more enjoyable flying experience.

Emerging Trends in Cabin Layouts

The aircraft seating market is witnessing a shift in cabin layouts, driven by changing consumer preferences and the need for airlines to maximize space. Airlines are exploring innovative configurations that allow for more seats without compromising comfort. This includes the introduction of high-density seating arrangements and the reconfiguration of existing aircraft to accommodate more passengers. According to recent studies, airlines that adopt these emerging trends can increase their revenue potential by up to 20%. The aircraft seating market is thus adapting to these changes, as manufacturers develop seating solutions that are versatile and can be easily integrated into various cabin layouts, ensuring that airlines remain competitive in a rapidly evolving market.

Regulatory Compliance and Safety Standards

The aircraft seating market is significantly influenced by stringent regulatory compliance and safety standards imposed by aviation authorities in the United States. These regulations dictate the design, materials, and installation of aircraft seats to ensure passenger safety during flights. Recent updates to safety regulations have prompted airlines to invest in new seating technologies that meet these requirements. For instance, the Federal Aviation Administration (FAA) has mandated specific crashworthiness standards that seating must adhere to, which has led to an increase in demand for advanced seating solutions. The aircraft seating market must continuously adapt to these evolving regulations, which can drive innovation and create opportunities for manufacturers to develop compliant seating options.

Technological Integration in Seating Solutions

The integration of advanced technologies into seating solutions is reshaping the aircraft seating market. Innovations such as smart seating, which includes features like built-in charging ports and entertainment systems, are becoming increasingly popular among airlines aiming to enhance the passenger experience. Furthermore, the use of lightweight materials and modular designs is gaining traction, as they contribute to fuel efficiency and operational cost savings. The aircraft seating market is likely to see a surge in demand for these technologically advanced seating options, as airlines strive to differentiate themselves in a competitive landscape. This trend not only improves passenger satisfaction but also aligns with broader industry goals of sustainability and efficiency.