Government Support and Subsidies

Government initiatives play a crucial role in shaping the agriculture equipment market. Various federal and state programs provide financial assistance and subsidies to farmers for purchasing modern machinery. For instance, the USDA offers grants and loans aimed at promoting the adoption of advanced agricultural technologies. This support not only alleviates the financial burden on farmers but also encourages the transition to more efficient equipment. As a result, the agriculture equipment market is likely to benefit from these policies, with an estimated increase in market size by 10% over the next five years due to enhanced accessibility to funding.

Rising Demand for Food Production

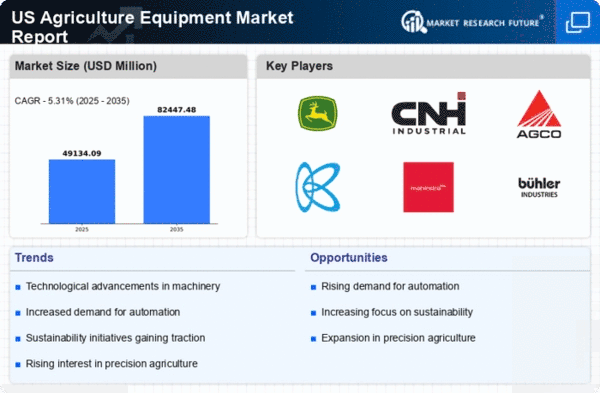

The agriculture equipment market is experiencing a notable surge in demand driven by the increasing need for food production. As the US population continues to grow, projected to reach approximately 350 million by 2030, the pressure on agricultural output intensifies. This necessitates the adoption of advanced machinery to enhance productivity and efficiency. The market for agriculture equipment is expected to reach $50 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 5%. Farmers are increasingly investing in modern equipment to meet these demands, which is likely to propel the agriculture equipment market further.

Environmental Regulations and Compliance

The agriculture equipment market is influenced by stringent environmental regulations aimed at promoting sustainable farming practices. Compliance with these regulations often necessitates the use of advanced machinery that minimizes environmental impact. For instance, equipment designed to reduce emissions and improve fuel efficiency is becoming essential for farmers. As regulations become more rigorous, the demand for compliant equipment is likely to rise, potentially increasing the market size by 15% in the coming years. This trend underscores the importance of innovation in the agriculture equipment market, as manufacturers strive to meet evolving environmental standards.

Increased Focus on Precision Agriculture

The agriculture equipment market is witnessing a shift towards precision agriculture, which emphasizes the use of technology to optimize field-level management. This approach allows farmers to make data-driven decisions, improving crop yields while minimizing resource use. The integration of GPS technology, drones, and IoT devices into farming practices is becoming more prevalent. It is estimated that precision agriculture could increase productivity by up to 20%, thereby driving the demand for specialized equipment. Consequently, the agriculture equipment market is likely to expand as farmers seek to invest in tools that facilitate precision farming techniques.

Growing Interest in Automation and Robotics

Automation and robotics are emerging as transformative forces within the agriculture equipment market. The adoption of automated machinery, such as robotic harvesters and drones, is gaining traction among farmers seeking to enhance operational efficiency. This trend is driven by labor shortages and the need for cost-effective solutions. The market for agricultural robots is projected to grow at a CAGR of 25% over the next five years, indicating a strong shift towards mechanization. As farmers increasingly recognize the benefits of automation, the agriculture equipment market is expected to evolve significantly, with a broader range of automated solutions becoming available.