Rising Costs of Chemical Pesticides

As the costs of chemical pesticides continue to rise, the agricultural insect-pheromones market is likely to see increased demand. Farmers are facing higher prices for synthetic pesticides due to regulatory changes and supply chain disruptions. This economic pressure is prompting a shift towards more cost-effective and environmentally friendly alternatives, such as pheromones. The agricultural insect-pheromones market is expected to capture a larger share of the pest control market, potentially increasing by 20% as farmers seek to reduce their reliance on expensive chemical solutions. This trend indicates a growing acceptance of pheromone-based products as viable pest management tools.

Integration of Precision Agriculture

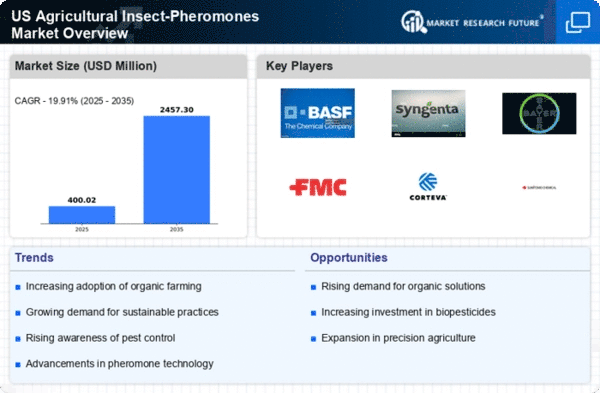

The integration of precision agriculture technologies is significantly impacting the agricultural insect-pheromones market. Farmers are increasingly utilizing data-driven approaches to optimize pest management strategies, which includes the application of pheromones. By employing sensors and drones, farmers can monitor pest populations and apply pheromone traps more effectively, reducing waste and enhancing crop yields. This trend is supported by the US government's initiatives to promote precision agriculture, which could lead to a market growth of around 15% in the next few years. The agricultural insect-pheromones market stands to benefit from this technological advancement, as it allows for more targeted and efficient pest control solutions.

Support from Agricultural Extension Services

The agricultural insect-pheromones market is receiving a boost from support provided by agricultural extension services across the US. These services play a crucial role in educating farmers about the benefits of using pheromones for pest management. By offering training programs and resources, extension services are helping to disseminate knowledge about effective pest control strategies that incorporate pheromones. This support is essential in promoting the adoption of innovative pest management solutions, which could lead to a market growth of approximately 12% in the coming years. The agricultural insect-pheromones market stands to gain from this collaborative effort to enhance sustainable farming practices.

Consumer Preference for Chemical-Free Produce

The agricultural insect-pheromones market is benefiting from a significant shift in consumer preferences towards produce that is free from chemical residues. As consumers become more health-conscious, there is a growing demand for food products that are free from synthetic pesticide residues. This trend is influencing farmers to adopt pest management strategies that utilize pheromones, which are perceived as safer and more natural. In the US, the organic food market has been expanding rapidly, with sales reaching approximately $62 billion in 2024. This consumer-driven demand is likely to propel the agricultural insect-pheromones market, as farmers seek to meet the expectations of health-conscious consumers.

Increasing Awareness of Sustainable Agriculture

The agricultural insect-pheromones market is experiencing growth due to a rising awareness of sustainable agricultural practices among farmers and consumers. As environmental concerns escalate, there is a shift towards eco-friendly pest management solutions. This trend is reflected in the increasing adoption of pheromone-based products, which are perceived as safer alternatives to traditional chemical pesticides. In the US, the market for organic pest control solutions is projected to grow at a CAGR of approximately 10% over the next five years. This heightened awareness not only drives demand for agricultural insect-pheromones but also encourages research and development in this sector, leading to innovative products that align with sustainable farming practices.