Increasing Vehicle Age

The average age of vehicles on the road in the United States has been steadily increasing, which appears to drive demand for aftermarket automotive parts and components. As vehicles age, the likelihood of wear and tear increases, necessitating repairs and replacements. In 2025, the average vehicle age is estimated to be around 12 years, indicating a substantial market for aftermarket parts. This trend suggests that consumers are more inclined to invest in maintaining older vehicles rather than purchasing new ones, thereby bolstering the United States Aftermarket Automotive Parts and Components Market. Furthermore, older vehicles often require specialized parts that may not be readily available through original equipment manufacturers, creating opportunities for aftermarket suppliers.

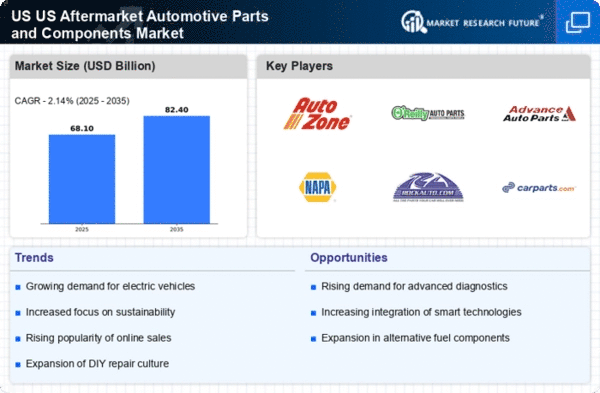

Expansion of Online Retail Platforms

The proliferation of online retail platforms has transformed the way consumers purchase automotive parts, significantly impacting the United States Aftermarket Automotive Parts and Components Market. E-commerce has made it easier for consumers to access a wide range of products, compare prices, and read reviews, thereby enhancing the shopping experience. In 2025, it is estimated that online sales of automotive parts will constitute a substantial portion of total sales, reflecting a shift in consumer purchasing habits. This trend indicates that traditional brick-and-mortar retailers must adapt to the digital landscape to remain competitive. The convenience and accessibility of online shopping are likely to continue driving growth in the aftermarket sector, as consumers increasingly prefer the ease of purchasing parts from the comfort of their homes.

Growing Awareness of Vehicle Maintenance

There is an increasing awareness among consumers regarding the importance of regular vehicle maintenance, which appears to be a key driver for the United States Aftermarket Automotive Parts and Components Market. As more individuals recognize that proactive maintenance can extend the lifespan of their vehicles and enhance safety, they are more likely to invest in quality aftermarket parts. In 2025, the market is expected to benefit from this heightened awareness, as consumers seek reliable components to ensure their vehicles operate efficiently. This trend suggests that educational campaigns and resources promoting vehicle care could further stimulate demand for aftermarket products, as informed consumers are more likely to prioritize quality and performance in their purchasing decisions.

Rising Consumer Preference for Customization

There is a notable shift in consumer behavior towards vehicle customization, which seems to be a significant driver for the United States Aftermarket Automotive Parts and Components Market. Enthusiasts and everyday drivers alike are increasingly seeking personalized modifications to enhance performance, aesthetics, and functionality. This trend is reflected in the growing sales of aftermarket accessories, such as custom wheels, exhaust systems, and performance chips. In 2025, the customization segment is projected to account for a considerable share of the market, as consumers prioritize individuality in their vehicles. This inclination towards personalization not only fuels demand for aftermarket parts but also encourages innovation among manufacturers to develop unique offerings.

Technological Innovations in Automotive Repair

Technological advancements in automotive repair and diagnostics are reshaping the landscape of the United States Aftermarket Automotive Parts and Components Market. Innovations such as advanced diagnostic tools and mobile applications are enabling consumers and repair shops to identify issues more accurately and efficiently. In 2025, the integration of technology in repair processes is likely to enhance the demand for specific aftermarket components that align with these innovations. As vehicles become more complex, the need for specialized parts that meet modern standards is expected to rise. This trend indicates that manufacturers who invest in research and development to create technologically compatible components may gain a competitive edge in the evolving aftermarket landscape.

Leave a Comment