Expansion of Smart Devices

The proliferation of smart devices is a key driver for the affective computing market, as these devices increasingly incorporate emotion recognition capabilities. From smartphones to smart home systems, the integration of affective computing technologies allows for more intuitive user interactions. For example, smart assistants that can detect user emotions can provide tailored responses, enhancing user satisfaction. The market for smart devices is expected to exceed $1 trillion by 2027, with a significant portion of this growth attributed to the incorporation of affective computing features. This trend suggests that as smart devices become more prevalent, the demand for affective computing solutions will likely increase, driving further innovation in the industry.

Technological Advancements in AI

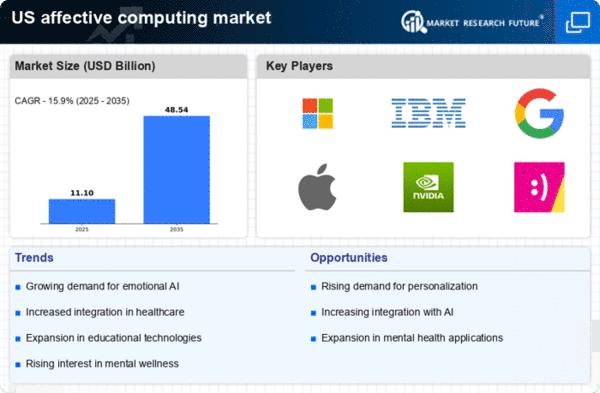

The affective computing market is experiencing a surge due to rapid advancements in artificial intelligence (AI) technologies. These innovations enable machines to recognize and interpret human emotions with increasing accuracy. For instance, AI algorithms are now capable of analyzing facial expressions, voice intonations, and physiological signals, which enhances user interaction across various applications. The market was projected to grow at a CAGR of approximately 30% from 2025 to 2030, driven by the integration of AI in sectors such as healthcare, automotive, and customer service. As organizations seek to improve user experience and engagement, the demand for affective computing solutions is likely to rise, positioning the industry for substantial growth in the coming years.

Integration in Mental Health Solutions

The affective computing market is gaining traction in the mental health sector, where technology is increasingly utilized to support emotional well-being. Tools that assess emotional states and provide feedback are becoming essential in therapeutic settings. For instance, applications that monitor mood and stress levels can assist mental health professionals in delivering personalized care. The market for mental health applications is projected to grow by over 25% annually, reflecting a growing recognition of the importance of emotional health. As mental health awareness continues to rise, the integration of affective computing technologies into treatment plans is likely to expand, further solidifying the industry's role in healthcare.

Rising Demand for Personalized Experiences

In the current landscape, there is a notable shift towards personalized experiences across various sectors, which significantly impacts the affective computing market. Consumers increasingly expect tailored interactions, whether in retail, entertainment, or online services. This demand is prompting businesses to adopt affective computing technologies that can analyze user emotions and preferences in real-time. For example, companies are leveraging emotion recognition software to enhance customer service and marketing strategies. The potential for increased customer satisfaction and loyalty is driving investments in this technology, with the market expected to reach a valuation of $50 billion by 2030. This trend indicates a robust future for the affective computing market as organizations strive to meet evolving consumer expectations.

Growing Interest in Human-Computer Interaction

The affective computing market is significantly influenced by the increasing focus on improving human-computer interaction (HCI). As technology becomes more integrated into daily life, the need for systems that can understand and respond to human emotions is becoming paramount. This interest is evident in sectors such as gaming, virtual reality, and customer service, where emotional engagement is crucial. The HCI market is projected to grow at a CAGR of around 20% through 2030, indicating a strong demand for affective computing technologies that enhance user experience. As organizations recognize the value of emotional intelligence in technology, the affective computing market is poised for continued expansion.