Rising Demand for Automation

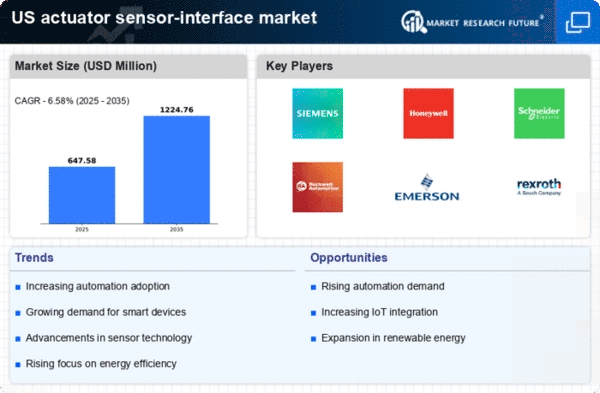

The actuator sensor-interface market experiences a notable surge in demand driven by the increasing adoption of automation across various industries. As manufacturers seek to enhance operational efficiency and reduce labor costs, the integration of automated systems becomes paramount. In the US, sectors such as manufacturing, automotive, and aerospace are particularly focused on automation, leading to a projected growth rate of approximately 8% annually in the actuator sensor-interface market. This trend indicates a shift towards more sophisticated control systems that utilize advanced sensors and actuators, thereby enhancing precision and reliability in operations. The actuator sensor-interface market is thus positioned to benefit significantly from this growing inclination towards automation, as companies invest in modernizing their processes to remain competitive.

Advancements in Sensor Technology

Technological advancements in sensor technology are playing a crucial role in shaping the actuator sensor-interface market. Innovations such as miniaturization, improved accuracy, and enhanced connectivity are driving the development of more sophisticated sensors that can seamlessly interface with actuators. In the US, the market for smart sensors is expected to reach $10 billion by 2026, reflecting a compound annual growth rate of around 12%. These advancements enable the actuator sensor-interface market to offer solutions that are not only more efficient but also capable of real-time data processing and feedback. As industries increasingly rely on data-driven decision-making, the demand for high-performance sensors that can integrate with actuators is likely to escalate, further propelling market growth.

Increased Focus on Safety Standards

The actuator sensor-interface market is significantly influenced by the heightened focus on safety standards across various sectors. Regulatory bodies in the US are continuously updating safety regulations, necessitating the incorporation of advanced actuator and sensor technologies to ensure compliance. Industries such as healthcare, automotive, and manufacturing are particularly affected, as they must adhere to stringent safety protocols. This trend is expected to drive investments in the actuator sensor-interface market, as companies seek to enhance their systems to meet these evolving standards. The financial implications are substantial, with estimates suggesting that compliance-related expenditures could account for up to 15% of operational budgets in some sectors. Consequently, the actuator sensor-interface market is likely to see increased demand for products that not only meet but exceed safety requirements.

Emerging Applications in Renewable Energy

The actuator sensor-interface market is increasingly influenced by the emergence of applications in the renewable energy sector. As the US transitions towards sustainable energy sources, the demand for efficient control systems in wind, solar, and hydroelectric power generation is on the rise. Actuators and sensors play a pivotal role in optimizing the performance of renewable energy systems, ensuring that they operate at peak efficiency. The actuator sensor-interface market is expected to see a growth rate of around 9% as investments in renewable energy infrastructure continue to expand. This trend not only highlights the importance of actuator and sensor technologies in energy management but also underscores the potential for innovation in developing solutions tailored to the unique challenges of renewable energy applications.

Growth of Smart Manufacturing Initiatives

The actuator sensor-interface market is poised for growth due to the rise of smart manufacturing initiatives in the US. As industries embrace Industry 4.0 principles, the integration of IoT and advanced automation technologies becomes essential. Smart manufacturing emphasizes the use of interconnected systems that rely on real-time data and analytics, which in turn drives the demand for sophisticated actuator and sensor interfaces. The actuator sensor-interface market is expected to benefit from this trend, with projections indicating a market expansion of approximately 10% over the next five years. This growth is fueled by the need for enhanced operational visibility and control, as manufacturers seek to optimize production processes and reduce downtime. The alignment of actuator and sensor technologies with smart manufacturing goals is likely to create new opportunities for innovation and investment.