Growing Geriatric Population

The increasing geriatric population is a significant factor contributing to the growth of the Ultrasound Systems Devices Market. As the elderly population expands, there is a corresponding rise in the prevalence of age-related health issues, necessitating regular monitoring and diagnostic imaging. Ultrasound systems are particularly valuable in managing conditions such as cardiovascular diseases and musculoskeletal disorders, which are common in older adults. Market projections indicate that the demand for ultrasound devices will continue to rise in tandem with the aging demographic. This trend underscores the critical role of ultrasound technology in addressing the healthcare needs of the geriatric population, thereby driving the Ultrasound Systems Devices Market.

Technological Advancements in Imaging

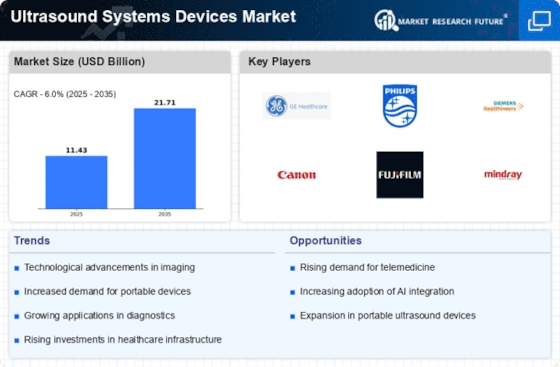

The Ultrasound Systems Devices Market is experiencing a surge in technological advancements that enhance imaging capabilities. Innovations such as 3D and 4D imaging, along with the integration of artificial intelligence, are revolutionizing diagnostic accuracy. These advancements not only improve the quality of images but also facilitate faster diagnoses, which is crucial in clinical settings. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% in the coming years. As healthcare providers increasingly adopt these advanced systems, the demand for high-quality ultrasound devices is likely to rise, further propelling the Ultrasound Systems Devices Market.

Expansion of Healthcare Infrastructure

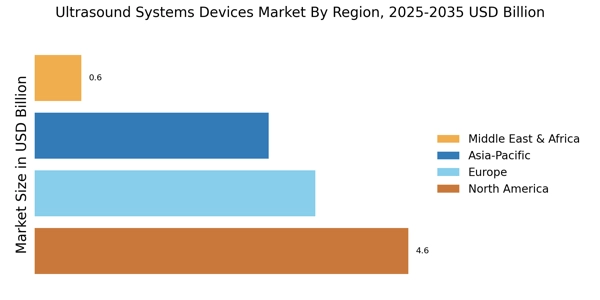

The expansion of healthcare infrastructure in various regions is significantly influencing the Ultrasound Systems Devices Market. As countries invest in healthcare facilities, the demand for advanced diagnostic tools, including ultrasound systems, is on the rise. This expansion is particularly pronounced in emerging markets, where healthcare access is improving. Market data suggests that regions with developing healthcare systems are expected to see a notable increase in ultrasound device installations. Consequently, this growth in infrastructure is likely to create new opportunities for manufacturers and suppliers within the Ultrasound Systems Devices Market, fostering a competitive landscape.

Increased Focus on Preventive Healthcare

The heightened emphasis on preventive healthcare is driving the Ultrasound Systems Devices Market forward. Healthcare systems are increasingly prioritizing early detection and monitoring of diseases, which ultrasound technology facilitates effectively. This focus aligns with global health initiatives aimed at reducing the burden of chronic diseases. Market analysis indicates that preventive ultrasound screenings are becoming more commonplace, particularly in high-risk populations. As healthcare providers adopt ultrasound as a primary tool for preventive measures, the demand for these devices is expected to grow, thereby enhancing the overall market landscape of the Ultrasound Systems Devices Market.

Rising Demand for Non-Invasive Procedures

The growing preference for non-invasive diagnostic procedures is a key driver in the Ultrasound Systems Devices Market. Patients and healthcare providers alike favor ultrasound due to its safety profile and lack of ionizing radiation. This trend is particularly evident in obstetrics and gynecology, where ultrasound is the standard for monitoring fetal development. The market data indicates that the obstetric ultrasound segment alone accounts for a substantial share of the overall market. As awareness of the benefits of non-invasive imaging continues to spread, the Ultrasound Systems Devices Market is expected to witness increased adoption rates, thereby enhancing its growth trajectory.