Growth in Industrial Automation

The ongoing trend towards industrial automation serves as a significant driver for the Ultra-Low-Power Microcontroller Market. Industries are increasingly adopting automation solutions to enhance efficiency and reduce operational costs. Ultra-low-power microcontrollers are essential in various applications, including sensors, actuators, and control systems, where energy efficiency is paramount. The industrial automation market is projected to reach approximately 300 billion USD by 2025, indicating a substantial opportunity for ultra-low-power microcontroller manufacturers. As industries seek to implement smart manufacturing practices, the demand for microcontrollers that can operate reliably in low-power environments is likely to increase, thereby fostering growth in this market segment.

Emergence of Smart Grid Solutions

The development of smart grid solutions is another critical driver for the Ultra-Low-Power Microcontroller Market. As energy providers seek to enhance grid efficiency and reliability, the integration of ultra-low-power microcontrollers becomes essential. These microcontrollers facilitate real-time monitoring and control of energy consumption, which is vital for the effective management of smart grids. The smart grid market is anticipated to grow to over 100 billion USD by 2026, underscoring the need for energy-efficient microcontroller solutions. By enabling advanced functionalities such as demand response and distributed energy resource management, ultra-low-power microcontrollers are positioned to play a pivotal role in the evolution of smart grid technologies.

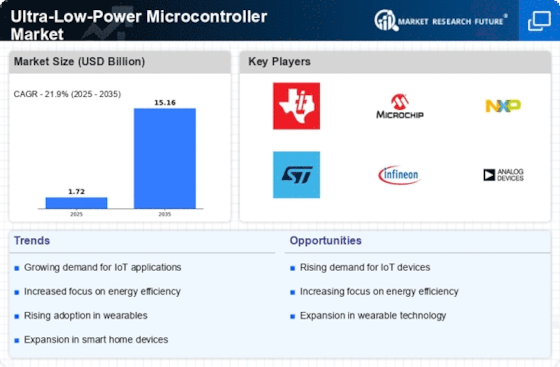

Rising Adoption of Wearable Devices

The increasing popularity of wearable devices is a key driver for the Ultra-Low-Power Microcontroller Market. As consumers seek health and fitness tracking solutions, manufacturers are integrating ultra-low-power microcontrollers to enhance battery life and performance. The market for wearable technology is projected to reach approximately 60 billion USD by 2026, indicating a robust demand for energy-efficient components. This trend necessitates the development of microcontrollers that can operate effectively with minimal power consumption, thereby propelling the growth of the ultra-low-power microcontroller segment. Furthermore, the integration of advanced sensors and connectivity features in wearables requires sophisticated microcontroller solutions, which further emphasizes the importance of ultra-low-power technology in this market.

Expansion of Smart Home Technologies

The proliferation of smart home technologies significantly influences the Ultra-Low-Power Microcontroller Market. As consumers increasingly adopt smart devices for home automation, the demand for energy-efficient microcontrollers rises. Smart home devices, such as smart thermostats, security systems, and lighting controls, require microcontrollers that can operate continuously without draining batteries. The smart home market is expected to grow to over 150 billion USD by 2027, highlighting the potential for ultra-low-power microcontrollers to play a crucial role in this expansion. Manufacturers are focusing on developing microcontrollers that not only support connectivity but also ensure long-lasting battery life, thus driving innovation in the ultra-low-power microcontroller sector.

Increased Focus on Environmental Sustainability

The heightened emphasis on environmental sustainability is driving the Ultra-Low-Power Microcontroller Market. As organizations and consumers alike prioritize eco-friendly solutions, the demand for energy-efficient microcontrollers is on the rise. These microcontrollers contribute to reducing energy consumption in various applications, from consumer electronics to industrial systems. The global push towards sustainability is reflected in the increasing investments in green technologies, with the market for energy-efficient devices expected to grow significantly in the coming years. This trend encourages manufacturers to innovate and develop ultra-low-power microcontrollers that align with sustainability goals, thereby enhancing their market presence and appeal.