Expansion of Automotive Electronics

The automotive industry is undergoing a transformation with the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). This shift is creating a burgeoning demand for ultra-fine copper powder, which is essential for various electronic components in modern vehicles. The Global Ultra-Fine Copper Powder (99.9999%) Market is poised to capitalize on this trend, as the automotive sector increasingly incorporates sophisticated electronics to improve safety and efficiency. Market forecasts indicate that the EV market alone is expected to grow exponentially, potentially reaching millions of units sold annually. This growth trajectory suggests a robust demand for ultra-fine copper powder, as manufacturers strive to meet the evolving needs of the automotive electronics landscape.

Growing Demand in Aerospace and Defense

The aerospace and defense sectors are experiencing a surge in demand for ultra-fine copper powder, which is utilized in various applications such as lightweight components and advanced materials. The Global Ultra-Fine Copper Powder (99.9999%) Market is likely to benefit from this trend, as manufacturers seek materials that provide high strength-to-weight ratios and excellent conductivity. Market analysis suggests that the aerospace industry is projected to grow significantly, with increasing investments in new aircraft and defense systems. This growth is expected to drive the demand for ultra-fine copper powder, as it plays a vital role in enhancing the performance and efficiency of aerospace and defense technologies.

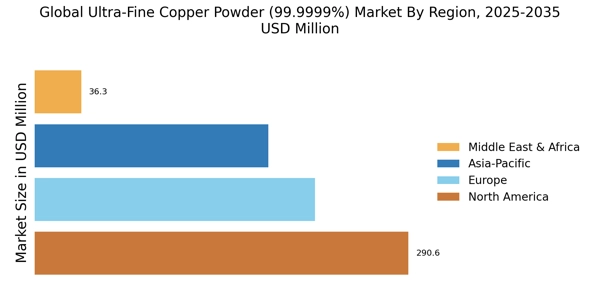

Rising Applications in Renewable Energy

The increasing focus on renewable energy sources is driving the demand for ultra-fine copper powder in various applications. This material is essential in the production of photovoltaic cells and batteries, which are critical components in solar panels and energy storage systems. As the world shifts towards sustainable energy solutions, the Global Ultra-Fine Copper Powder (99.9999%) Market is likely to experience substantial growth. Reports indicate that the renewable energy sector is projected to expand significantly, with investments reaching trillions of dollars over the next decade. This trend suggests a robust market for ultra-fine copper powder, as manufacturers seek high-purity materials to enhance the efficiency and longevity of energy systems.

Advancements in Electronics Manufacturing

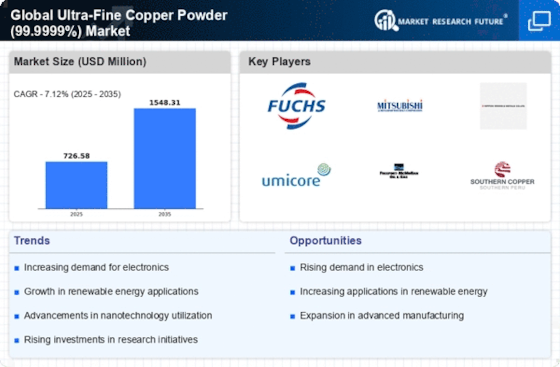

The electronics manufacturing sector is undergoing rapid advancements, which is positively impacting the Global Ultra-Fine Copper Powder (99.9999%) Market. Ultra-fine copper powder is increasingly utilized in the production of high-performance electronic components, including circuit boards and connectors. The demand for miniaturization and enhanced performance in electronic devices is driving manufacturers to seek materials that offer superior conductivity and reliability. Market data indicates that the electronics industry is expected to grow at a compound annual growth rate (CAGR) of over 5% in the coming years, further fueling the need for ultra-fine copper powder. This growth presents opportunities for suppliers to cater to the evolving requirements of the electronics sector.

Increased Investment in Research and Development

Investment in research and development (R&D) is a crucial driver for the Global Ultra-Fine Copper Powder (99.9999%) Market. Companies are increasingly allocating resources to innovate and improve the properties of ultra-fine copper powder, aiming to enhance its applications across various industries. This focus on R&D is likely to lead to the development of new formulations and production techniques, which could expand the market reach of ultra-fine copper powder. Furthermore, government initiatives to promote technological advancements in materials science are expected to bolster R&D efforts. As a result, the market may witness a surge in innovative products that meet the specific needs of diverse applications.