Increased Focus on Cost Efficiency

Cost efficiency remains a crucial driver for the video as-a-service market in the UK. Organizations are increasingly looking for ways to optimize their budgets while maintaining high-quality video services. The subscription-based model prevalent in the video as-a-service market allows businesses to reduce upfront capital expenditures associated with traditional video infrastructure. Reports suggest that companies can save up to 40% on operational costs by switching to video as-a-service solutions. This financial incentive is particularly appealing to small and medium-sized enterprises, which may lack the resources for extensive video setups. As more businesses recognize the potential for cost savings, the video as-a-service market is expected to experience robust growth, driven by the demand for economically viable video solutions.

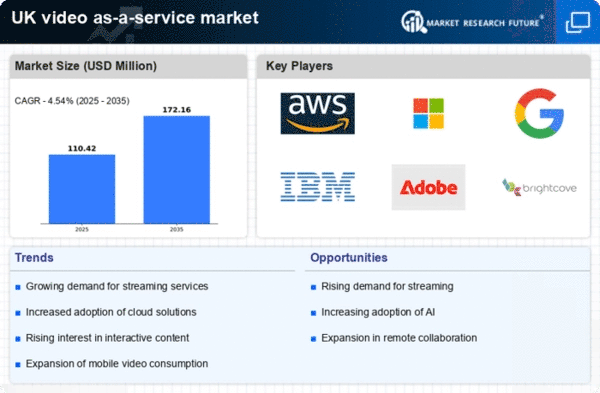

Expansion of Mobile Video Consumption

The expansion of mobile video consumption is a notable driver for the video as-a-service market in the UK. With the rise of smartphones and tablets, consumers are increasingly accessing video content on-the-go. Recent statistics indicate that mobile devices account for over 50% of all video views in the UK, highlighting a shift in viewing habits. This trend compels content providers to optimize their services for mobile platforms, thereby driving growth in the video as-a-service market. As businesses adapt to this mobile-centric landscape, they are likely to invest in solutions that enhance mobile video delivery. Consequently, the video as-a-service market is expected to thrive as it aligns with the growing demand for mobile-friendly video content.

Growing Adoption of Cloud Technologies

The increasing adoption of cloud technologies is a pivotal driver for the video as-a-service market. Businesses in the UK are increasingly migrating their operations to the cloud, which facilitates the delivery of video content without the need for extensive on-premises infrastructure. This shift is evidenced by a reported growth of 30% in cloud service usage among UK enterprises over the past year. As organizations seek to enhance their operational efficiency and reduce costs, the video as-a-service market is likely to benefit from this trend. The flexibility and scalability offered by cloud solutions enable companies to tailor their video services to meet specific needs, thereby driving further adoption. Consequently, the video as-a-service market is positioned to expand as more businesses recognize the advantages of cloud-based video solutions.

Rising Consumer Demand for On-Demand Content

Consumer preferences in the UK are shifting towards on-demand content, which serves as a significant driver for the video as-a-service market. With the proliferation of smart devices and high-speed internet, viewers are increasingly seeking flexibility in how and when they consume video content. Recent surveys indicate that over 60% of UK consumers prefer on-demand services over traditional broadcasting. This trend is compelling content providers to adapt their offerings, leading to a surge in the video as-a-service market. As a result, businesses are investing in platforms that allow for seamless access to a wide array of video content, thus enhancing user experience. The video as-a-service market is likely to see continued growth as providers innovate to meet the evolving demands of consumers.

Technological Advancements in Video Delivery

Technological advancements are significantly influencing the video as-a-service market in the UK. Innovations such as 4K streaming, artificial intelligence, and machine learning are enhancing the quality and efficiency of video delivery. These technologies enable providers to offer superior viewing experiences, which is increasingly important in a competitive landscape. For instance, AI-driven analytics can optimize content recommendations, thereby improving user engagement. The integration of such technologies is likely to attract more businesses to adopt video as-a-service solutions. As the market evolves, the video as-a-service market is poised to benefit from these advancements, which may lead to increased customer satisfaction and retention.