Focus on Cost Reduction Strategies

Cost reduction remains a primary driver in the transportation management-systems market. Companies are increasingly seeking solutions that can help them minimize operational expenses while maintaining service quality. The implementation of transportation management systems can lead to a reduction in transportation costs by approximately 15% through better route planning and load optimization. In the UK, businesses are under constant pressure to improve their bottom line, prompting them to invest in systems that provide visibility and control over their logistics operations. This focus on cost efficiency is likely to continue shaping the market landscape as companies strive to remain competitive.

Rising Demand for E-commerce Solutions

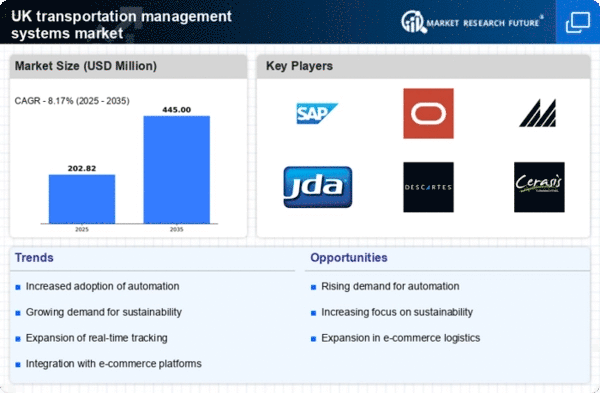

The transportation management-systems market is significantly influenced by the rising demand for e-commerce solutions in the UK. With online shopping becoming a staple for consumers, logistics providers are under pressure to enhance their delivery capabilities. This shift has led to an estimated growth of 25% in the demand for efficient transportation management systems that can handle increased order volumes and provide real-time tracking. Companies are seeking systems that can streamline operations, reduce delivery times, and improve customer satisfaction. Consequently, the transportation management-systems market is adapting to meet these evolving needs, ensuring that logistics providers can effectively manage their supply chains.

Integration of Sustainability Practices

The transportation management-systems market is witnessing a growing emphasis on sustainability practices. As environmental concerns become more pressing, logistics companies are increasingly adopting systems that facilitate eco-friendly operations. This includes optimizing routes to reduce fuel consumption and implementing carbon tracking features. The UK government has set ambitious targets for reducing carbon emissions, which is pushing companies to align their operations with these goals. As a result, the transportation management-systems market is evolving to incorporate features that support sustainable practices, potentially leading to a 20% reduction in carbon footprints for logistics providers that adopt these systems.

Technological Advancements in Logistics

The transportation management-systems market is experiencing a surge in technological advancements that enhance logistics operations. Innovations such as artificial intelligence (AI) and machine learning (ML) are being integrated into transportation management systems, allowing for improved route optimization and predictive analytics. This integration is expected to increase operational efficiency by up to 30%, thereby reducing costs and improving service delivery. Furthermore, the UK government has been investing in smart infrastructure, which supports the adoption of these advanced technologies. As a result, logistics companies are increasingly turning to sophisticated transportation management systems to stay competitive in a rapidly evolving market.

Regulatory Compliance and Safety Standards

Regulatory compliance is a critical driver in the transportation management-systems market. The UK has stringent regulations governing transportation and logistics, which necessitate that companies adopt systems that ensure compliance with safety standards and legal requirements. Transportation management systems are increasingly being designed to help businesses navigate these complex regulations, thereby reducing the risk of penalties and enhancing operational safety. The market is likely to see a rise in demand for systems that offer compliance tracking and reporting features, as companies prioritize adherence to regulations while striving to maintain efficiency in their operations.