Increased Focus on Business Intelligence

The relational database market is increasingly aligned with the growing focus on business intelligence (BI) among UK enterprises. As organizations strive to gain insights from their data, the demand for relational databases that support BI tools is on the rise. The relational database market is adapting to this trend by offering solutions that seamlessly integrate with various BI applications, enabling users to perform complex analyses and generate actionable insights. This shift is reflected in the market, where the adoption of relational databases for BI purposes is projected to increase by approximately 15% over the next few years. Companies are recognizing the value of data visualization and reporting capabilities, which are essential for informed decision-making. Consequently, investments in relational database technologies that enhance BI functionalities are likely to continue growing.

Regulatory Compliance and Data Governance

In the UK, the relational database market is significantly influenced by the increasing emphasis on regulatory compliance and data governance. With stringent regulations such as GDPR, organizations are compelled to adopt relational database systems that ensure data protection and privacy. This regulatory landscape has led to a heightened focus on data management practices, prompting businesses to invest in relational database solutions that facilitate compliance. The relational database market is witnessing a shift towards systems that offer robust auditing, reporting, and data lineage capabilities. As a result, companies are more inclined to choose relational databases that not only meet compliance requirements but also enhance their overall data governance frameworks. This trend is expected to drive market growth, as organizations prioritize investments in technologies that mitigate risks associated with data breaches and non-compliance.

Growing Adoption of Hybrid Cloud Solutions

The relational database market is witnessing a growing adoption of hybrid cloud solutions among UK businesses. As organizations seek to balance the benefits of cloud computing with on-premises infrastructure, relational databases that support hybrid environments are becoming increasingly popular. This trend is indicative of a broader shift towards flexible data management strategies, allowing companies to optimize costs while maintaining control over sensitive data. The relational database market is responding to this demand by developing solutions that facilitate seamless integration between cloud and on-premises systems. Recent data suggests that the hybrid cloud segment is expected to account for over 30% of the relational database market by 2026. This shift not only enhances operational agility but also enables organizations to leverage the scalability of cloud resources while ensuring compliance with local data regulations.

Rising Demand for Data Management Solutions

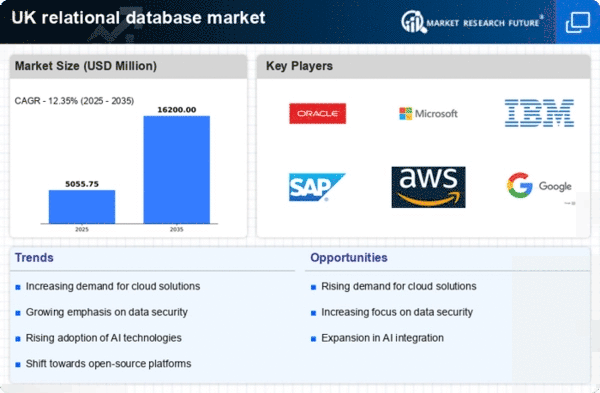

The relational database market is experiencing a notable surge in demand for efficient data management solutions. As businesses in the UK increasingly rely on data-driven decision-making, the need for robust database systems becomes paramount. According to recent statistics, the market is projected to grow at a CAGR of approximately 10% over the next five years. This growth is driven by the necessity for organizations to manage vast amounts of data effectively, ensuring accuracy and accessibility. Furthermore, the relational database market is adapting to the evolving needs of sectors such as finance, healthcare, and retail, where data integrity and real-time access are critical. Companies are investing in relational database technologies to enhance operational efficiency and support analytics initiatives, thereby solidifying their competitive edge in the market.

Technological Advancements in Database Solutions

Technological advancements are playing a pivotal role in shaping the relational database market. Innovations such as in-memory processing, distributed databases, and enhanced query optimization techniques are transforming how data is stored and accessed. The relational database market is witnessing the emergence of next-generation database solutions that offer improved performance and scalability. For instance, the integration of machine learning algorithms into database management systems is enabling predictive analytics and automated data handling. This evolution is particularly relevant for sectors that require real-time data processing, such as e-commerce and telecommunications. As organizations in the UK seek to leverage these advancements, the demand for modern relational database solutions is expected to rise, potentially leading to a market growth rate of around 12% in the coming years.