Rise of Pet Ownership

The surge in pet ownership across the UK is significantly influencing the pet food market. Recent statistics indicate that around 60% of households now own a pet, which has led to an increased demand for pet food products. This trend is particularly evident among younger demographics, who are more likely to adopt pets and invest in premium food options. The pet food market is responding to this growing consumer base by diversifying product offerings to cater to various pet types and dietary preferences. Additionally, the emotional bond between pets and their owners is prompting consumers to prioritize quality over cost, further propelling the market. As more individuals view pets as family members, the demand for specialized and high-quality pet food continues to rise.

Changing Consumer Preferences

The evolving preferences of consumers are significantly impacting the pet food market. There is a noticeable shift towards convenience, with many pet owners seeking ready-to-eat meals and subscription services that deliver pet food directly to their homes. This trend is particularly appealing to busy professionals and families, who prioritize time-saving solutions. The pet food market is adapting by offering a variety of convenient options, including meal kits and single-serve packages. Additionally, the rise of social media influences consumer choices, as pet owners increasingly rely on online reviews and recommendations. This dynamic landscape suggests that brands must remain agile and responsive to these changing preferences to maintain competitiveness in the pet food market.

Increased Focus on Sustainability

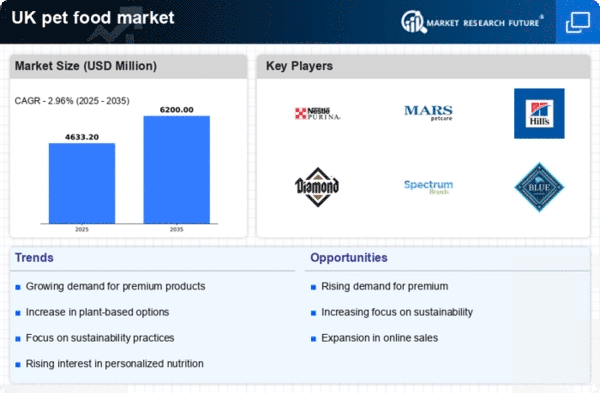

Sustainability is emerging as a crucial driver in the pet food market, as consumers become more environmentally conscious. The demand for eco-friendly packaging and sustainably sourced ingredients is on the rise, with many brands committing to reducing their carbon footprint. Recent surveys indicate that approximately 40% of pet owners are willing to pay a premium for sustainable products. The pet food market is responding by developing products that align with these values, such as plant-based diets and recyclable packaging. This shift not only appeals to environmentally aware consumers but also positions brands as responsible market players. As sustainability becomes a core value for many consumers, the pet food market is likely to see continued growth in this segment.

Health Consciousness Among Pet Owners

The increasing awareness of health and nutrition among pet owners is a pivotal driver in the pet food market. As pet owners become more health-conscious, they seek high-quality, nutritious food options for their pets. This trend is reflected in the growing demand for natural and organic pet food products, which has seen a rise of approximately 25% in the last few years. The pet food market is adapting to this shift by introducing products that are free from artificial additives and preservatives. Furthermore, the emphasis on specific dietary needs, such as grain-free or high-protein options, is becoming more pronounced. This focus on health not only enhances the well-being of pets but also aligns with the owners' lifestyle choices, thereby driving sales in the pet food market.

Technological Advancements in Pet Food Production

Technological innovations in the production and distribution of pet food are reshaping the landscape of the pet food market. Advances in food processing technology, such as extrusion and freeze-drying, enhance the nutritional value and shelf life of pet food products. Moreover, the integration of data analytics and artificial intelligence in supply chain management is optimizing inventory and reducing waste. The pet food market is likely to benefit from these advancements, as they enable manufacturers to respond swiftly to changing consumer preferences. Additionally, the use of e-commerce platforms for direct-to-consumer sales is becoming more prevalent, allowing brands to reach a wider audience. This technological evolution not only improves product quality but also enhances the overall consumer experience.