Advancements in Inhaler Technology

Technological innovations in inhaler design and functionality are significantly influencing the metered dose-inhalers market. Recent developments include the introduction of smart inhalers equipped with digital health technologies that track usage patterns and provide feedback to patients. These advancements aim to enhance adherence to prescribed therapies, which is crucial for effective disease management. The market is witnessing a shift towards more user-friendly devices that cater to diverse patient needs, including those with limited dexterity. Furthermore, the integration of sensors and mobile applications is expected to improve patient engagement and monitoring. As these technologies continue to evolve, they are likely to attract more users, thereby driving growth in the metered dose-inhalers market.

Government Initiatives and Funding

Government initiatives aimed at improving respiratory health are playing a pivotal role in the metered dose-inhalers market. The UK government has implemented various programs to enhance access to respiratory care, including funding for inhaler prescriptions and public health campaigns. These initiatives are designed to raise awareness about respiratory diseases and promote the use of effective treatment options, including metered dose-inhalers. Additionally, the National Health Service (NHS) has been actively involved in ensuring that patients receive timely access to inhalers, which is crucial for managing chronic respiratory conditions. Such support from governmental bodies is likely to bolster the metered dose-inhalers market, as it encourages both healthcare providers and patients to prioritize effective treatment.

Growing Focus on Preventive Healthcare

The increasing emphasis on preventive healthcare in the UK is contributing to the growth of the metered dose-inhalers market. As healthcare systems shift towards proactive management of chronic diseases, there is a heightened focus on early diagnosis and treatment of respiratory conditions. This trend is reflected in the rising number of health screenings and awareness campaigns aimed at identifying individuals at risk of developing respiratory diseases. Consequently, more patients are being prescribed metered dose-inhalers as a preventive measure, which is likely to drive market growth. The proactive approach to healthcare not only improves patient outcomes but also reduces the long-term burden on healthcare systems, further supporting the demand for inhalers.

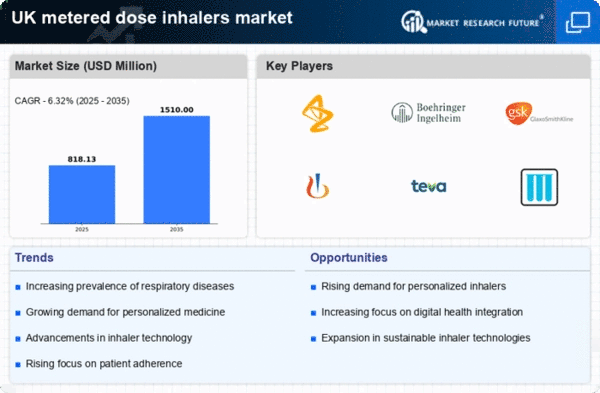

Rising Demand for Personalized Medicine

The trend towards personalized medicine is emerging as a significant driver for the metered dose-inhalers market. Patients are increasingly seeking tailored treatment options that cater to their specific health needs and preferences. This shift is prompting manufacturers to develop inhalers that can deliver customized dosages and formulations based on individual patient profiles. The ability to personalize treatment regimens is expected to enhance patient satisfaction and adherence, which are critical for effective disease management. As healthcare providers adopt more individualized approaches to treatment, the demand for metered dose-inhalers is likely to rise, reflecting the broader trend of personalization in healthcare.

Increasing Prevalence of Respiratory Diseases

The rising incidence of respiratory diseases in the UK is a primary driver for the metered dose-inhalers market. Conditions such as asthma and chronic obstructive pulmonary disease (COPD) are becoming more prevalent, affecting millions of individuals. According to recent health statistics, approximately 5.4 million people in the UK are currently receiving treatment for asthma, while COPD affects around 1.2 million. This growing patient population necessitates the use of metered dose-inhalers, as they are essential for delivering medication effectively. The increasing burden of these diseases is likely to propel demand for inhalers, thereby expanding the metered dose-inhalers market. As healthcare providers focus on improving patient outcomes, the reliance on these devices is expected to grow, further solidifying their role in respiratory disease management.