Growing Demand for Scalability

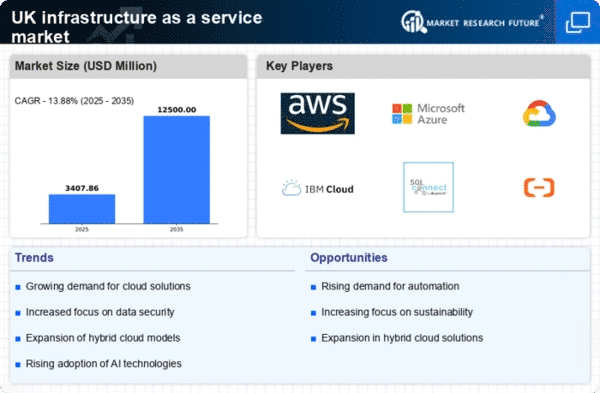

The infrastructure as-a-service market is experiencing a notable surge in demand for scalability. Businesses in the UK are increasingly seeking flexible solutions that allow them to scale their IT resources up or down based on fluctuating needs. This trend is particularly evident among small to medium-sized enterprises (SMEs) that require cost-effective solutions without the burden of maintaining physical infrastructure. According to recent data, the market is projected to grow at a CAGR of approximately 25% over the next five years, driven by the need for agile IT environments. As companies embrace digital transformation, the infrastructure as-a-service market is positioned to play a pivotal role in enabling rapid deployment and resource optimization.

Emergence of Advanced Technologies

The emergence of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), is reshaping the landscape of the infrastructure as-a-service market. UK businesses are increasingly integrating these technologies into their operations to enhance decision-making and operational efficiency. IaaS providers are responding by offering platforms that support AI and ML workloads, enabling organizations to leverage data analytics for competitive advantage. This trend is expected to propel the market forward, with estimates suggesting a potential increase in market value by £5 billion by 2027. The integration of advanced technologies into IaaS solutions is likely to be a key driver of innovation and growth in the sector.

Cost Efficiency and Budget Management

Cost efficiency remains a critical driver in the infrastructure as-a-service market. UK businesses are increasingly turning to IaaS solutions to manage their IT budgets more effectively. By leveraging cloud-based infrastructure, organizations can reduce capital expenditures associated with hardware purchases and maintenance. This shift allows for a more predictable operating expense model, which is particularly appealing in uncertain economic climates. Reports indicate that companies can save up to 30% on IT costs by adopting IaaS solutions. As financial prudence becomes paramount, the infrastructure as-a-service market is likely to see continued growth as organizations seek to optimize their spending while maintaining robust IT capabilities.

Increased Focus on Digital Transformation

The ongoing digital transformation initiatives across various sectors in the UK are significantly influencing the infrastructure as-a-service market. Organizations are increasingly adopting cloud-based solutions to enhance operational efficiency and improve customer experiences. This shift is driven by the need for real-time data access and collaboration tools that support remote work and innovation. As businesses invest in digital technologies, the infrastructure as-a-service market is expected to expand, with projections indicating a potential market size increase to £10 billion by 2026. The alignment of IaaS offerings with digital strategies is likely to be a key factor in this growth.

Regulatory Compliance and Data Sovereignty

Regulatory compliance is a pressing concern for businesses operating in the UK, particularly in sectors such as finance and healthcare. The infrastructure as-a-service market is responding to this need by offering solutions that ensure data sovereignty and compliance with local regulations. Companies are increasingly aware of the importance of data protection laws, such as the GDPR, which mandate strict guidelines for data handling and storage. As a result, IaaS providers are enhancing their offerings to include robust compliance features, which could lead to a market growth of approximately 20% in the coming years. This focus on regulatory adherence is likely to drive further adoption of infrastructure as-a-service solutions.