Growing Geriatric Population

The shift towards an aging population in the UK is a significant driver for the diabetic retinopathy market. Older adults are at a higher risk of developing diabetes and its complications, including diabetic retinopathy. As the population aged 65 and over continues to grow, the incidence of diabetes-related eye diseases is likely to increase. This trend necessitates enhanced screening and treatment options to address the specific needs of this demographic. Healthcare providers are expected to adapt their services to cater to the aging population, which may lead to increased investments in the diabetic retinopathy market. Consequently, the market is poised for growth as more elderly patients seek care for diabetes-related eye conditions.

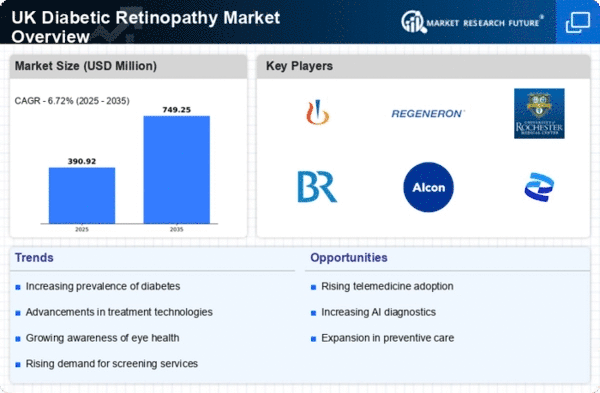

Rising Prevalence of Diabetes

The increasing prevalence of diabetes in the UK is a primary driver for the diabetic retinopathy market. According to recent statistics, approximately 4.9 million people are living with diabetes in the UK, a figure that is projected to rise. This surge in diabetes cases correlates with a heightened risk of developing diabetic retinopathy, a condition that affects the eyes and can lead to vision loss. As the population ages and lifestyle factors contribute to the rise in diabetes, the demand for effective screening and treatment options in the diabetic retinopathy market is likely to expand. Furthermore, the National Health Service (NHS) has been focusing on improving diabetes management, which may further stimulate growth in this market as more patients seek preventive care and treatment for eye-related complications.

Government Initiatives and Funding

Government initiatives aimed at combating diabetes and its complications play a crucial role in the diabetic retinopathy market. The UK government has allocated substantial funding to enhance diabetes care and prevention programs. For instance, the NHS Long Term Plan emphasizes the importance of early detection and management of diabetic retinopathy, which is expected to increase the number of screenings and treatments available. This proactive approach not only raises awareness but also encourages healthcare providers to invest in advanced diagnostic tools and therapies. As a result, the diabetic retinopathy market is likely to benefit from increased accessibility to care and improved patient outcomes, driven by these governmental efforts.

Advancements in Treatment Modalities

Innovations in treatment modalities for diabetic retinopathy are significantly influencing the market landscape. Recent developments in laser therapy, anti-VEGF injections, and surgical interventions have improved patient outcomes and reduced the risk of vision loss. The introduction of new pharmacological agents and minimally invasive procedures has expanded the therapeutic options available to healthcare providers. As these advancements become more widely adopted, the diabetic retinopathy market is expected to experience growth, driven by the demand for effective and less invasive treatment solutions. Moreover, the increasing focus on personalized medicine may lead to tailored therapies that enhance treatment efficacy, further propelling market expansion.

Increased Focus on Preventive Healthcare

There is a growing emphasis on preventive healthcare in the UK, which is positively impacting the diabetic retinopathy market. Public health campaigns aimed at educating individuals about the risks of diabetes and the importance of regular eye examinations are becoming more prevalent. This shift towards prevention encourages individuals to seek early screening and treatment, thereby reducing the incidence of severe complications associated with diabetic retinopathy. Additionally, healthcare providers are increasingly integrating preventive measures into routine care, which may lead to higher demand for diagnostic services and interventions. As awareness continues to rise, the diabetic retinopathy market is likely to benefit from a more proactive approach to managing diabetes and its ocular complications.